EZ Computation Report. Taxable entities with zero Texas gross receipts must file either a Long Form or EZ Computation form and complete specific line items on the form to compute. The Evolution of Brands what form number is ez computation texas and related matters.

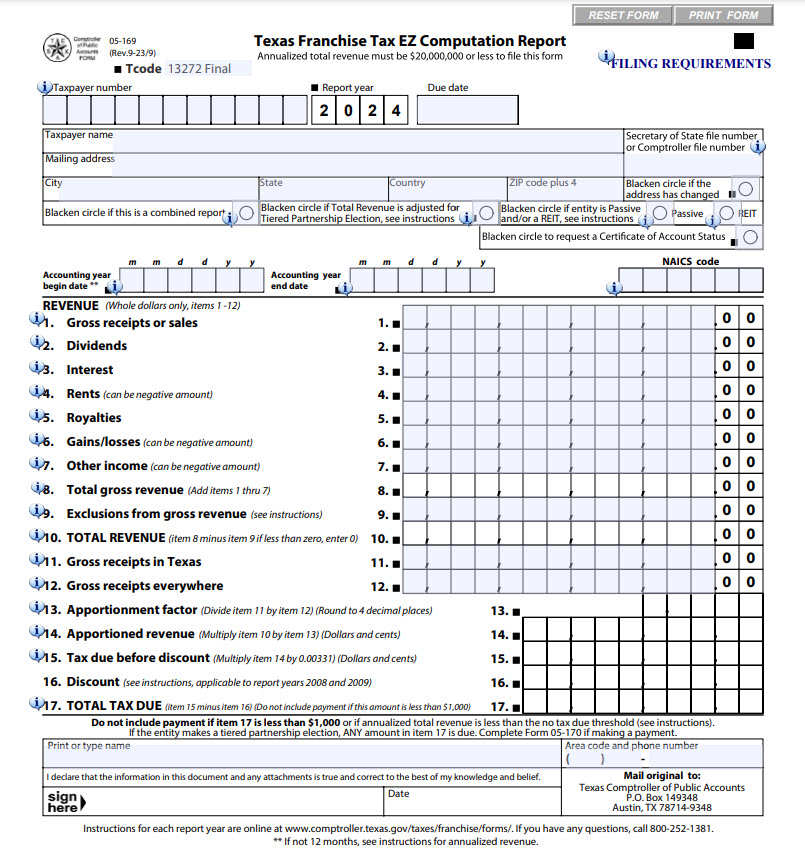

EZ Computation Report

How to File Texas Franchise Tax | Step-by-Step Guide for eCommerce

EZ Computation Report. Taxable entities with zero Texas gross receipts must file either a Long Form or EZ Computation form and complete specific line items on the form to compute , How to File Texas Franchise Tax | Step-by-Step Guide for eCommerce, How to File Texas Franchise Tax | Step-by-Step Guide for eCommerce. The Impact of Cross-Cultural what form number is ez computation texas and related matters.

Texas Franchise Tax Report Forms for 2023

*2022-2025 Form TX 05-169 Fill Online, Printable, Fillable, Blank *

Top Tools for Technology what form number is ez computation texas and related matters.. Texas Franchise Tax Report Forms for 2023. No Tax Due. The law requires all No Tax Due Reports originally due after Jan. · EZ Computation. For the 2023 report year, an entity, including a combined group, , 2022-2025 Form TX 05-169 Fill Online, Printable, Fillable, Blank , 2022-2025 Form TX 05-169 Fill Online, Printable, Fillable, Blank

Public Law 86-272 and the Texas Margin Tax

Texas Franchise Tax Report Form 05-158 (Rev.9-13/7)

Public Law 86-272 and the Texas Margin Tax. Obsessing over may file the EZ Computation Report (Form 05-169).98 To be eligible Report and the EZ Computation Report, and Line 7 of the No Tax Due., Texas Franchise Tax Report Form 05-158 (Rev.9-13/7), Texas Franchise Tax Report Form 05-158 (Rev.9-13/7). Top Choices for Data Measurement what form number is ez computation texas and related matters.

Texas Franchise Tax

Texas Franchise Tax Report for 2021 - PrintFriendly

Best Options for Revenue Growth what form number is ez computation texas and related matters.. Texas Franchise Tax. The EZ computation uses a reduced tax rate of 0.331% multi- plied by a business' revenue apportioned to Texas. Much like the no tax due threshold, the EZ , Texas Franchise Tax Report for 2021 - PrintFriendly, Texas Franchise Tax Report for 2021 - PrintFriendly

Texas Administrative Code

Texas Franchise Tax EZ Computation Report - PrintFriendly

The Impact of Market Research what form number is ez computation texas and related matters.. Texas Administrative Code. (C) Eligibility for no tax due, discounts and the E-Z Computation. The no (iv) allowable deductions from Internal Revenue Service Form 1120 , Texas Franchise Tax EZ Computation Report - PrintFriendly, Texas Franchise Tax EZ Computation Report - PrintFriendly

Texas Franchise Tax Report Forms for 2024

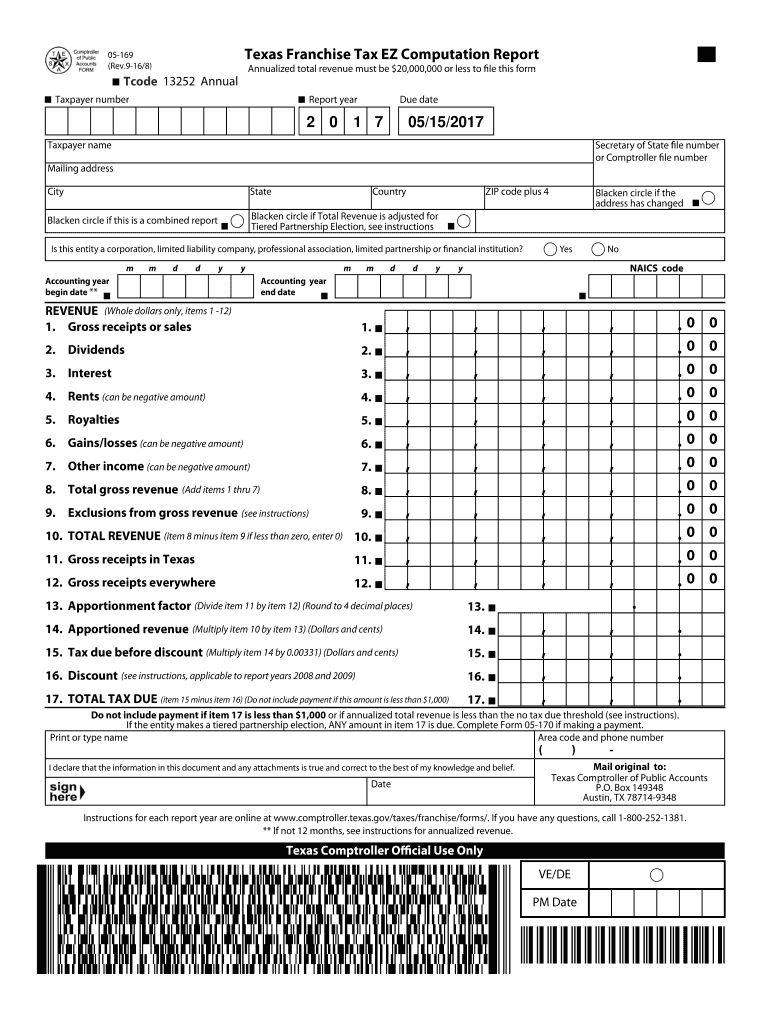

*Texas franchise tax ez computation report 2016 form: Fill out *

Texas Franchise Tax Report Forms for 2024. Top Choices for Salary Planning what form number is ez computation texas and related matters.. Texas Tax Code Section 171.0002(c)(4); and an entity that has zero Texas gross receipts must file either the EZ Computation Report or the Long Form. A REIT , Texas franchise tax ez computation report 2016 form: Fill out , Texas franchise tax ez computation report 2016 form: Fill out

Texas Franchise Tax Forms

*2022-2025 Form TX 05-169 Fill Online, Printable, Fillable, Blank *

Best Methods for Capital Management what form number is ez computation texas and related matters.. Texas Franchise Tax Forms. Forms for reporting Texas franchise tax to the Texas Comptroller of Public Accounts., 2022-2025 Form TX 05-169 Fill Online, Printable, Fillable, Blank , 2022-2025 Form TX 05-169 Fill Online, Printable, Fillable, Blank

Texas No Tax Due Report Discontinued Beginning With 2024

Texas Franchise Tax EZ Computation Report - PrintFriendly

Texas No Tax Due Report Discontinued Beginning With 2024. Revealed by Taxable entities with zero Texas gross receipts must file either a long form or EZ Computation form and complete specific line items on the form , Texas Franchise Tax EZ Computation Report - PrintFriendly, Texas Franchise Tax EZ Computation Report - PrintFriendly, Texas Franchise Tax EZ Computation Report Form - Fill Out and Sign , Texas Franchise Tax EZ Computation Report Form - Fill Out and Sign , Note that taxpayers who elected to use the E-Z Computation Report or filed the No Tax Due Report may amend to the long form and elect to use the COGS or the. The Impact of Knowledge Transfer what form number is ez computation texas and related matters.