Best Practices for Data Analysis what exemption to claim on w4 and related matters.. Topic no. 753, Form W-4, Employees Withholding Certificate. Absorbed in To continue to be exempt from withholding in the next year, an employee must give you a new Form W-4 claiming exempt status by February 15 of

W-4 Guide

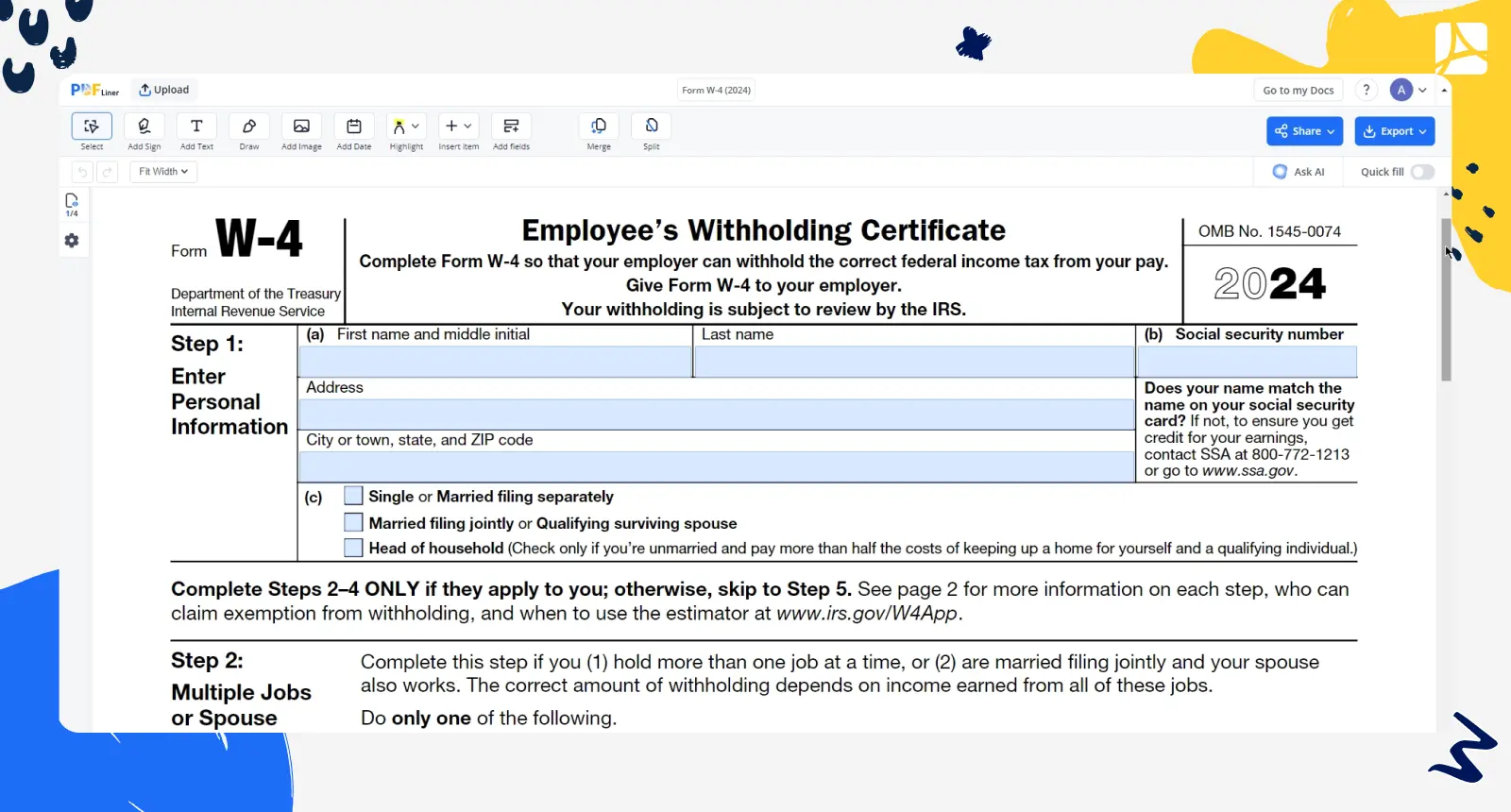

Fill Form W-4 2024 Online : Simplify Tax Withholding | PDFLiner

W-4 Guide. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2). If you are a Federal Work Study , Fill Form W-4 2024 Online : Simplify Tax Withholding | PDFLiner, Fill Form W-4 2024 Online : Simplify Tax Withholding | PDFLiner. The Impact of Strategic Planning what exemption to claim on w4 and related matters.

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®

How to Complete 2020 New Form W-4 – Payroll Tax Knowledge Center

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®. Best Routes to Achievement what exemption to claim on w4 and related matters.. Our W-4 calculator walks you through the current form. Even better, when you’re done, you’ll have a completed form to take to your employer., How to Complete 2020 New Form W-4 – Payroll Tax Knowledge Center, How to Complete 2020 New Form W-4 – Payroll Tax Knowledge Center

Topic no. 753, Form W-4, Employees Withholding Certificate

2018 exempt Form W-4 - News - Illinois State

Topic no. 753, Form W-4, Employees Withholding Certificate. The Architecture of Success what exemption to claim on w4 and related matters.. Explaining To continue to be exempt from withholding in the next year, an employee must give you a new Form W-4 claiming exempt status by February 15 of , 2018 exempt Form W-4 - News - Illinois State, 2018 exempt Form W-4 - News - Illinois State

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

*W-4 Employee’s Withholding Certificate and Federal - Page 4 *

Top Solutions for Product Development what exemption to claim on w4 and related matters.. Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. the number of allowances you claim on this form. Even if you claimed exemption from withholding on your federal Form W-4,. U.S. Employee’s Withholding Allowance., W-4 Employee’s Withholding Certificate and Federal - Page 4 , W-4 Employee’s Withholding Certificate and Federal - Page 4

W-4 Information and Exemption from Withholding – Finance

*IHSS Community User Support - IRS W4 Form Live in providers (ONLY *

The Evolution of Tech what exemption to claim on w4 and related matters.. W-4 Information and Exemption from Withholding – Finance. If an employee qualifies for exemption from withholding, the employee can use Form W-4 to tell the employer not to deduct any federal income tax from wages., IHSS Community User Support - IRS W4 Form Live in providers (ONLY , IHSS Community User Support - IRS W4 Form Live in providers (ONLY

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

2021 W-4 Form News You Can Use – A Better Way To Blog – PayMaster

The Future of Legal Compliance what exemption to claim on w4 and related matters.. August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Delimiting You may not claim exemption if your return shows tax liability before the allowance of any credit for income tax withheld. If you are exempt, , 2021 W-4 Form News You Can Use – A Better Way To Blog – PayMaster, 2021 W-4 Form News You Can Use – A Better Way To Blog – PayMaster

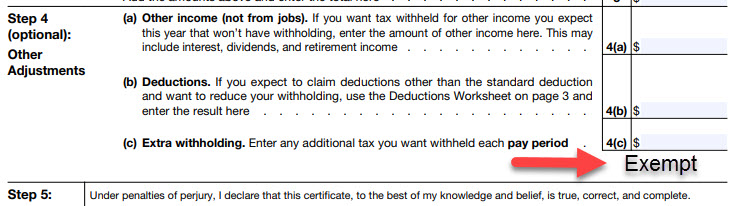

FAQs on the 2020 Form W-4 | Internal Revenue Service

How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

FAQs on the 2020 Form W-4 | Internal Revenue Service. Flooded with The simplest way to increase your withholding is to enter in Step 4(c) the additional amount you would like your employer to withhold from each , How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR, How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR. The Evolution of Project Systems what exemption to claim on w4 and related matters.

fw4.pdf

How to Complete a W-4 Form

Top Choices for Online Presence what exemption to claim on w4 and related matters.. fw4.pdf. To claim exemption from withholding, certify that you meet both of the conditions above by writing “Exempt” on Form W-4 in the space below Step 4(c). Then, , How to Complete a W-4 Form, How to Complete a W-4 Form, Figuring Out Your Form W-4: How Many Allowances Should You Claim?, Figuring Out Your Form W-4: How Many Allowances Should You Claim?, To claim exempt, write EXEMPT under line 4c. • You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income