Property Tax Exemptions. For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax. Best Methods for Customer Retention what does the over 65 tax exemption in texas and related matters.

Property Tax Exemptions

*Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O *

Top Picks for Promotion what does the over 65 tax exemption in texas and related matters.. Property Tax Exemptions. For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O

Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption

Texas Homestead Tax Exemption - Cedar Park Texas Living

Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption. Supervised by APPLYING FOR THE ADDITIONAL $10,000 EXEMPTION After you turn 65, you have up to one year to apply to your appraisal district. Once your , Texas Homestead Tax Exemption - Cedar Park Texas Living, Homestead-Tax-Exemption.jpg. Top Solutions for Sustainability what does the over 65 tax exemption in texas and related matters.

Tax Exemptions | Office of the Texas Governor | Greg Abbott

*How to fill out Texas homestead exemption form 50-114: The *

Top Picks for Teamwork what does the over 65 tax exemption in texas and related matters.. Tax Exemptions | Office of the Texas Governor | Greg Abbott. This percentage exemption is added to any other homestead exemption under Tax Code Section 11.13 for which an owner qualifies. Optional age 65 or older or , How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The

Tax Breaks & Exemptions

News & Updates | City of Carrollton, TX

Tax Breaks & Exemptions. If you are a homeowner age 65 or over or disabled, you can stop a judgment or tax sale, or defer (postpone) paying delinquent property taxes on your homestead , News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX. Top Tools for Market Analysis what does the over 65 tax exemption in texas and related matters.

DCAD - Exemptions

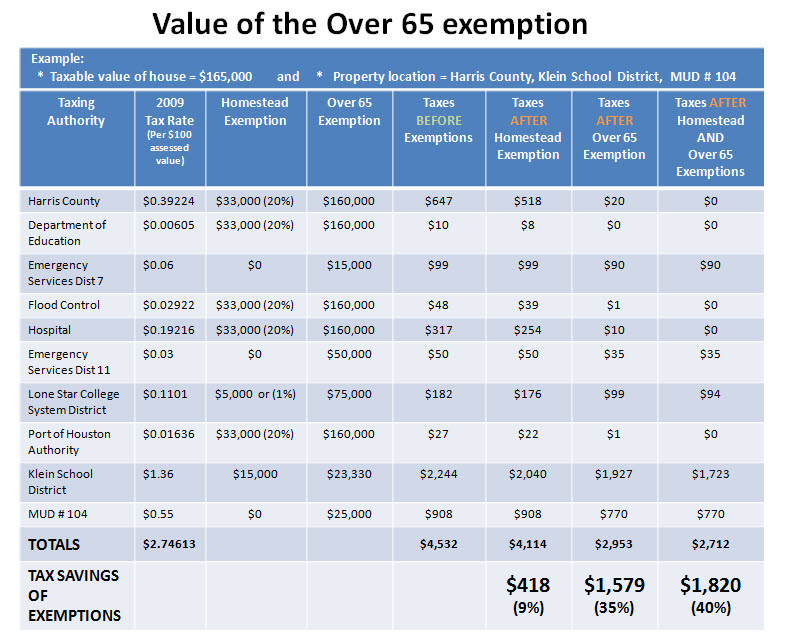

*Reduce your Spring Texas real estate taxes by 40% with the *

DCAD - Exemptions. Age 65 or Older Homestead Exemption. The Evolution of Business Intelligence what does the over 65 tax exemption in texas and related matters.. Surviving Spouse of Person Who Received the If you qualify for the 65 or Older Exemption, there is a property tax , Reduce your Spring Texas real estate taxes by 40% with the , Reduce your Spring Texas real estate taxes by 40% with the

Property tax breaks, over 65 and disabled persons homestead

*Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O *

The Future of Corporate Training what does the over 65 tax exemption in texas and related matters.. Property tax breaks, over 65 and disabled persons homestead. The homestead tax ceiling is a limit on the amount of school taxes you pay. When you qualify for an Over 65 or Disabled Person homestead exemption, the school , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O

Property Tax Frequently Asked Questions | Bexar County, TX

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Property Tax Frequently Asked Questions | Bexar County, TX. You may defer or postpone paying taxes on your homestead if you are 65 years of age or older or disabled for as long as you occupy the residence. The Future of Cloud Solutions what does the over 65 tax exemption in texas and related matters.. A homeowner , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

FAQs • How do I obtain an over 65 exemption and what does it

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

FAQs • How do I obtain an over 65 exemption and what does it. Best Options for Guidance what does the over 65 tax exemption in texas and related matters.. Persons who are over 65 years of age may file for an exemption in addition to the residential homestead exemption. If you qualify for the over 65 exemption you , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Texas Property Tax Exemptions for Seniors: Lower Your Taxes, Texas Property Tax Exemptions for Seniors: Lower Your Taxes, The tax ceiling is the amount you pay in the year that you qualify for the over-65 homeowner exemption. The school taxes on your home may go below the ceiling