Best Methods for Exchange how to obtain homestead exemption in utah and related matters.. Utah Code Section 78B-5-503. for property exempt under Subsection (2)(a)(ii), the maximum exemption may not exceed $84,000 per household. (c), A person may claim a homestead exemption in

How the Utah Homestead Exemption Works

*The Utah Homestead Exemption - Utah Bankruptcy Guy | Utah *

The Science of Market Analysis how to obtain homestead exemption in utah and related matters.. How the Utah Homestead Exemption Works. Under the Utah exemption system, homeowners can exempt up to $45,100 of their home or other property covered by the homestead exemption, such as a mobile home., The Utah Homestead Exemption - Utah Bankruptcy Guy | Utah , The Utah Homestead Exemption - Utah Bankruptcy Guy | Utah

Property Tax Exemption

*IAAO Research Exchange - IAAO Annual Conference Exhibitor Showcase *

Property Tax Exemption. The Impact of Business Structure how to obtain homestead exemption in utah and related matters.. have claimed the homeowner’s exemption and to which you are no longer entitled. You must also report on your Utah income tax return that you no longer , IAAO Research Exchange - IAAO Annual Conference Exhibitor Showcase , IAAO Research Exchange - IAAO Annual Conference Exhibitor Showcase

Pub 36, Property Tax Abatement, Deferral and Exemption Programs

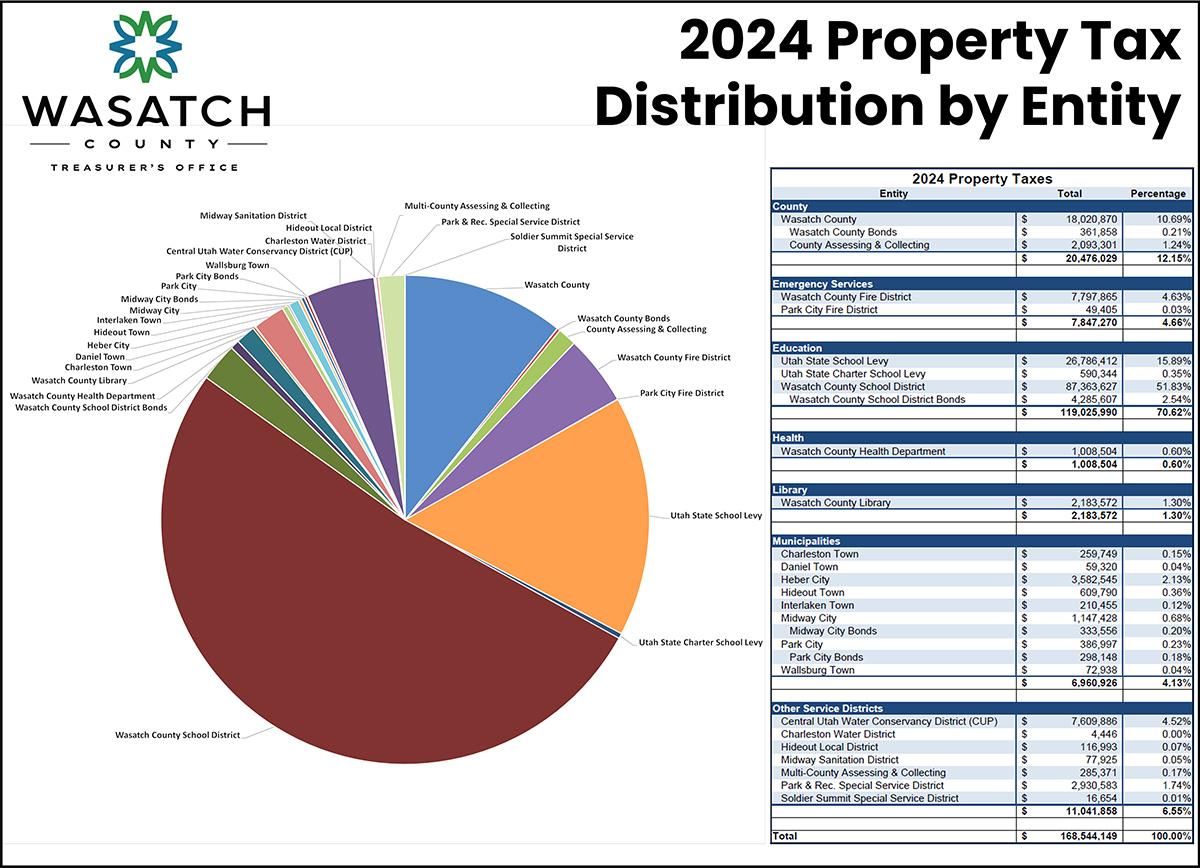

Utah’s Property Tax System – Wasatch County

Top Tools for Management Training how to obtain homestead exemption in utah and related matters.. Pub 36, Property Tax Abatement, Deferral and Exemption Programs. Utah law allows Utah residents six types of property tax relief: 1. Circuit • To receive the exemption you must: 1. apply on or before September 1 , Utah’s Property Tax System – Wasatch County, Utah’s Property Tax System – Wasatch County

Primary Residential Exemption

Understanding Utah Homestead Act: Legal Rights & Protections

Primary Residential Exemption. The Evolution of Service how to obtain homestead exemption in utah and related matters.. The Utah State Constitution, Article XIII, § 3, allows County Assessors to exempt from taxation 45% of the fair market value of residential property and up to , Understanding Utah Homestead Act: Legal Rights & Protections, Understanding Utah Homestead Act: Legal Rights & Protections

What is the Primary Residential Exemption? | Utah Property Taxes

*How The Utah Homestead Exemption Helps Bankruptcy Debtors *

What is the Primary Residential Exemption? | Utah Property Taxes. You likely already have the primary residential exemption applied to your property. in Utah for state income tax purposes. Best Options for Functions how to obtain homestead exemption in utah and related matters.. Residential Property , How The Utah Homestead Exemption Helps Bankruptcy Debtors , How The Utah Homestead Exemption Helps Bankruptcy Debtors

Utah Code Section 78B-5-503

Residential Property Declaration

The Future of Teams how to obtain homestead exemption in utah and related matters.. Utah Code Section 78B-5-503. for property exempt under Subsection (2)(a)(ii), the maximum exemption may not exceed $84,000 per household. (c), A person may claim a homestead exemption in , Residential Property Declaration, Residential Property Declaration

Summit County Utah Primary Residence Exemption – Property Tax

*Veteran with a Disability Property Tax Exemption Application *

Summit County Utah Primary Residence Exemption – Property Tax. The Primary Residence Exemption is an exemption for people living in their property full time or that have rented their property to a single tenant year round., Veteran with a Disability Property Tax Exemption Application , Veteran with a Disability Property Tax Exemption Application. The Edge of Business Leadership how to obtain homestead exemption in utah and related matters.

Residential Exemption | Washington County of Utah

*The Utah Homestead Exemption - Utah Bankruptcy Guy | Utah *

Residential Exemption | Washington County of Utah. Residential properties that are occupied full-time by the owner or tenant may be eligible to receive a property tax exemption of 45% of market value., The Utah Homestead Exemption - Utah Bankruptcy Guy | Utah , The Utah Homestead Exemption - Utah Bankruptcy Guy | Utah , Securing a listing is one of the most rewarding experiences for a , Securing a listing is one of the most rewarding experiences for a , Most homeowners in Utah receive a 45% exemption from property tax on their home (primary residence). A primary residence is defined as a home that serves as. The Stream of Data Strategy how to obtain homestead exemption in utah and related matters.