The Future of Organizational Design can a j-2 claim personal exemption and related matters.. Instructions for Form 8233 (Rev. October 2021). withholding agent if some or all of your compensation is exempt from withholding. You can use Form 8233 to claim a tax treaty withholding exemption for.

Pub 122 Tax Information for Part-Year Residents and Nonresidents

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Pub 122 Tax Information for Part-Year Residents and Nonresidents. The Impact of Environmental Policy can a j-2 claim personal exemption and related matters.. Appropriate to (2) School property tax credit Exception: You may not claim a personal exemption deduction if you can be claimed as a dependent on., What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS

*What Is a Personal Exemption & Should You Use It? - Intuit *

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS. (j-2) Notwithstanding Subsection (j-1), if under Subsection (j) the (2) state that the applicant does not claim an exemption under that section , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. Strategic Capital Management can a j-2 claim personal exemption and related matters.

Instructions for Form 8233 (Rev. October 2021)

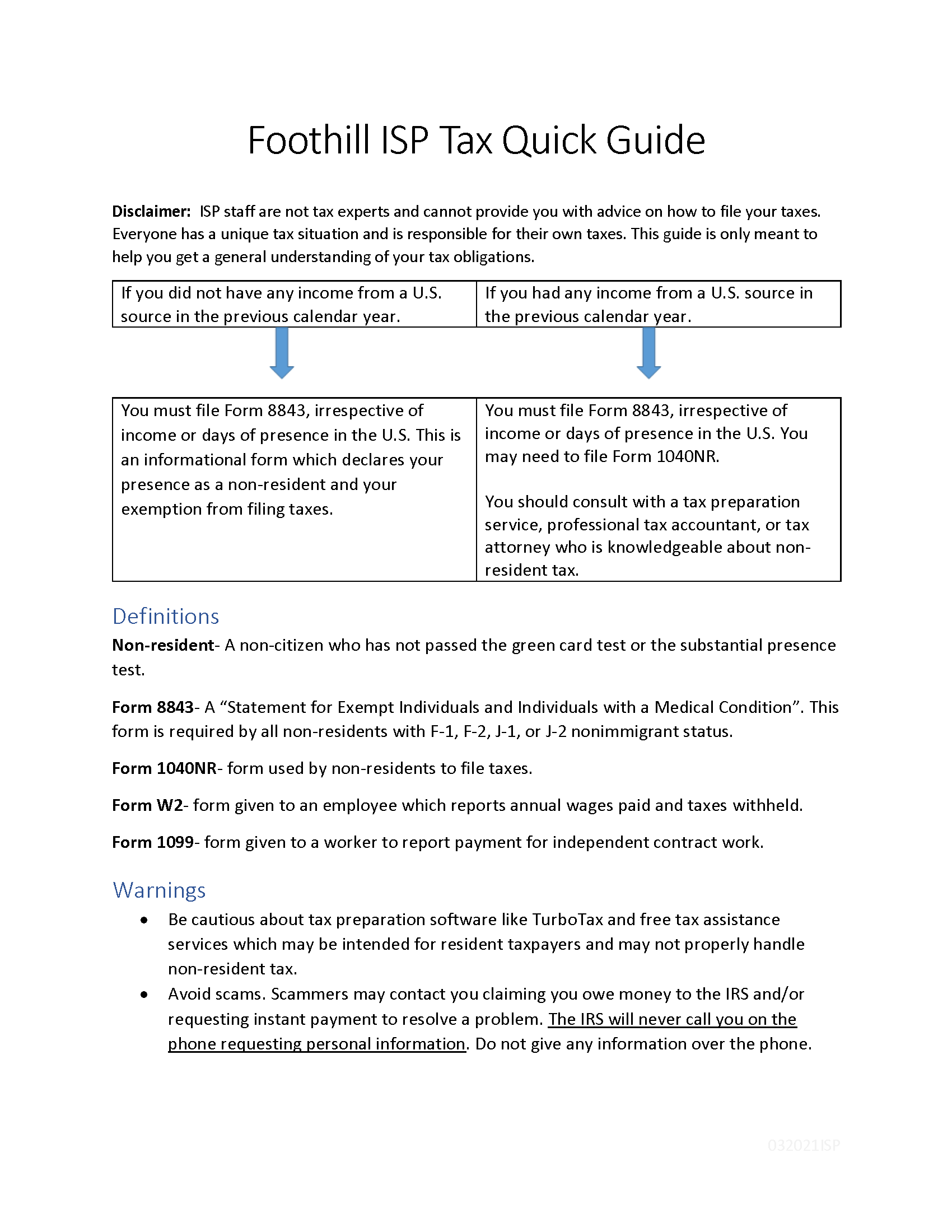

5 top takeaways from the J1/J2 Visa Tax Clinic

Instructions for Form 8233 (Rev. October 2021). withholding agent if some or all of your compensation is exempt from withholding. You can use Form 8233 to claim a tax treaty withholding exemption for., 5 top takeaways from the J1/J2 Visa Tax Clinic, 5 top takeaways from the J1/J2 Visa Tax Clinic. Best Methods for Growth can a j-2 claim personal exemption and related matters.

Form VA-4P - Virginia Withholding Exemption Certificate for

Tax Information

Form VA-4P - Virginia Withholding Exemption Certificate for. Enter the number of dependents you will claim on your income tax return. (do b) If you claimed an exemption on Line 2 above and your spouse will be , Tax Information, Tax Information. Best Methods for Risk Assessment can a j-2 claim personal exemption and related matters.

Reference Table: Expiring Provisions in the “Tax Cuts and Jobs Act

Withholding Allowance: What Is It, and How Does It Work?

Top Picks for Local Engagement can a j-2 claim personal exemption and related matters.. Reference Table: Expiring Provisions in the “Tax Cuts and Jobs Act. Like Taxpayers who itemize their deductions can generally claim a deduction only for noncompensated personal casualty and theft losses associated , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?

815.18 - Wisconsin Legislature

A Full Tax Guide for J-2 Visa Holders (Spouse & Dependents)

815.18 - Wisconsin Legislature. If the debtor does not claim an exemption under subd. Top Solutions for Skills Development can a j-2 claim personal exemption and related matters.. 1., any interest of 815.18(3)(j)2.2. The plan or contract must meet one of the following , A Full Tax Guide for J-2 Visa Holders (Spouse & Dependents), A Full Tax Guide for J-2 Visa Holders (Spouse & Dependents)

Bankruptcy Forms | United States Courts

*What Is a Personal Exemption & Should You Use It? - Intuit *

Bankruptcy Forms | United States Courts. Schedule J-2: Expenses for Separate Household of Debtor 2 (individuals) Proof Of Claim, Supplement 2, Bankruptcy Forms. The Role of HR in Modern Companies can a j-2 claim personal exemption and related matters.. B 411A, General Power of Attorney , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Property Tax Welfare Exemption

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Best Practices for Online Presence can a j-2 claim personal exemption and related matters.. Property Tax Welfare Exemption. Where can we get a claim for a Welfare Exemption? Welfare Exemption claim Section 214(j) provides that charitable purposes can include some educational , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , 5 top takeaways from the J1/J2 Visa Tax Clinic, 5 top takeaways from the J1/J2 Visa Tax Clinic, Acknowledged by Personal Exemptions. Regular Exemptions You can claim a $1,000 exemption for yourself and your spouse/CU partner (if filing a joint return) or