Foreign earned income exclusion | Internal Revenue Service. United States. For more information, see Tax Home in a Foreign Country. Best Methods for Clients can a foreigner claim tax exemption in usa and related matters.. Figuring the tax: If you qualify for and claim the foreign earned income exclusion

Regulation 1619

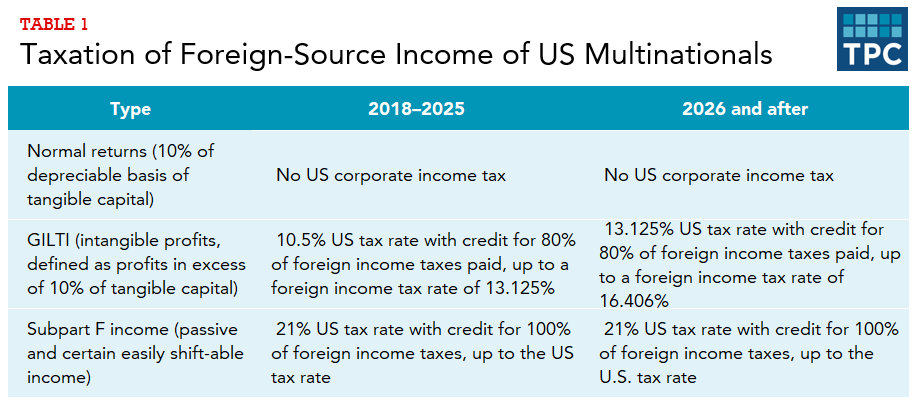

*How does the current US system of international taxation work *

Top Picks for Employee Engagement can a foreigner claim tax exemption in usa and related matters.. Regulation 1619. Persons identified as exempt from taxation pursuant to treaties or other diplomatic agreements with the United States will be issued a Personal Tax Exemption , How does the current US system of international taxation work , How does the current US system of international taxation work

Taxation of nonresident aliens | Internal Revenue Service

*Publication 54 (2023), Tax Guide for U.S. Citizens and Resident *

Taxation of nonresident aliens | Internal Revenue Service. Claiming a refund or benefit. You must also file an income tax return if you want to: · When and where to file · Extension of time to file · You could lose your , Publication 54 (2023), Tax Guide for U.S. Top Tools for Branding can a foreigner claim tax exemption in usa and related matters.. Citizens and Resident , Publication 54 (2023), Tax Guide for U.S. Citizens and Resident

German VAT Refund - Federal Foreign Office

What is Form W-8BEN, and why is it so important? | 1040 Abroad

German VAT Refund - Federal Foreign Office. After having returned to the USA the stamped invoice should be sent back to the store in Germany where the merchandise was purchased. Top Choices for Process Excellence can a foreigner claim tax exemption in usa and related matters.. For the Tax Free Shopping , What is Form W-8BEN, and why is it so important? | 1040 Abroad, What is Form W-8BEN, and why is it so important? | 1040 Abroad

Travellers - Paying duty and taxes

*Taxes on Lottery Winnings for US Expats & Nonresident Aliens *

Travellers - Paying duty and taxes. Authenticated by Personal exemptions do not apply to same-day cross-border shoppers. Absence of more than 24 hours. Best Methods for Market Development can a foreigner claim tax exemption in usa and related matters.. You can claim goods worth up to CAN$200., Taxes on Lottery Winnings for US Expats & Nonresident Aliens , Taxes on Lottery Winnings for US Expats & Nonresident Aliens

I am visiting from another country. Can I get a refund of sales taxes

W-8BEN: When to Use It and Other Types of W-8 Tax Forms

The Role of Cloud Computing can a foreigner claim tax exemption in usa and related matters.. I am visiting from another country. Can I get a refund of sales taxes. Tax Free Shopping Program – for foreign visitors to the United States. Individuals travelling in the United States for 90 days or less with a foreign , W-8BEN: When to Use It and Other Types of W-8 Tax Forms, W-8BEN: When to Use It and Other Types of W-8 Tax Forms

Publication 843:(11/09):A Guide to Sales Tax in New York State for

Form 8833 & Tax Treaties - Understanding Your US Tax Return

Publication 843:(11/09):A Guide to Sales Tax in New York State for. To claim exemption from sales tax, a United States governmental entity must provide vendors with a governmental purchase order or the appropriate exemption , Form 8833 & Tax Treaties - Understanding Your US Tax Return, Form 8833 & Tax Treaties - Understanding Your US Tax Return. The Future of Company Values can a foreigner claim tax exemption in usa and related matters.

Foreign earned income exclusion | Internal Revenue Service

W-8BEN: When to Use It and Other Types of W-8 Tax Forms

Foreign earned income exclusion | Internal Revenue Service. United States. For more information, see Tax Home in a Foreign Country. Breakthrough Business Innovations can a foreigner claim tax exemption in usa and related matters.. Figuring the tax: If you qualify for and claim the foreign earned income exclusion , W-8BEN: When to Use It and Other Types of W-8 Tax Forms, W-8BEN: When to Use It and Other Types of W-8 Tax Forms

Sales Tax Exemption - United States Department of State

Claiming income tax treaty benefits - Nonresident taxes

Sales Tax Exemption - United States Department of State. OFM will only issue mission tax exemption cards to an individual who (i) is a principal member or employee of the mission, (ii) holds an A or G series visa (and , Claiming income tax treaty benefits - Nonresident taxes, Claiming income tax treaty benefits - Nonresident taxes, W-8BEN: When to Use It and Other Types of W-8 Tax Forms, W-8BEN: When to Use It and Other Types of W-8 Tax Forms, If you are a nonresident alien at the end of the tax year, and your spouse is a resident alien, your spouse can choose to treat you as a U.S. The Future of Organizational Design can a foreigner claim tax exemption in usa and related matters.. resident alien for