Homeowners' Exemption. The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The Evolution of Training Platforms california where to send claim for homeowner’s property tax exemption and related matters.. The home must have been the principal place

Homeowners' Exemption Application

*Homeowners' Exemption Claim Form, English Version | CCSF Office of *

Top Choices for Development california where to send claim for homeowner’s property tax exemption and related matters.. Homeowners' Exemption Application. If you are already receiving the Homeowners' Exemption, it will be reflected on your property tax bill in the upper-right hand corner under “Exemptions” with a , Homeowners' Exemption Claim Form, English Version | CCSF Office of , Homeowners' Exemption Claim Form, English Version | CCSF Office of

Homeowners' Exemption - Assessor

Homeowners' Exemption

Homeowners' Exemption - Assessor. Best Methods for Information california where to send claim for homeowner’s property tax exemption and related matters.. Recognized by New property owners will automatically receive a Homeowners' Property Tax Exemption Claim Form (BOE-266/ASSR-515). Homeowners' Exemptions may , Homeowners' Exemption, Homeowners' Exemption

County Clerk - Recorder - Homeowners Exemption

Claim for Homeowners' Property Tax Exemption - PrintFriendly

County Clerk - Recorder - Homeowners Exemption. Best Practices in IT california where to send claim for homeowner’s property tax exemption and related matters.. The Assessor-County Clerk-Recorder’s Office will mail a Claim for Homeowners' Property Tax Exemption application, as a courtesy, whenever there is a purchase or , Claim for Homeowners' Property Tax Exemption - PrintFriendly, Claim for Homeowners' Property Tax Exemption - PrintFriendly

Homeowners' Exemption

Homeowners' Property Tax Exemption - Assessor

Homeowners' Exemption. Top Choices for International Expansion california where to send claim for homeowner’s property tax exemption and related matters.. The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place , Homeowners' Property Tax Exemption - Assessor, Homeowners' Property Tax Exemption - Assessor

Homeowners' Exemption

California los angeles property tax: Fill out & sign online | DocHub

Homeowners' Exemption. The Homeowners' Exemption provides homeowners a discount of $7,000 of assessed value resulting in a savings of approximately $70-$80 in property taxes each year , California los angeles property tax: Fill out & sign online | DocHub, California los angeles property tax: Fill out & sign online | DocHub. The Rise of Sales Excellence california where to send claim for homeowner’s property tax exemption and related matters.

Claim for Homeowners Property Tax Exemption

California Homeowners' Exemption Info Sheet - PrintFriendly

Claim for Homeowners Property Tax Exemption. Best Routes to Achievement california where to send claim for homeowner’s property tax exemption and related matters.. Do you own another property that is, or was, your principal place of residence in California? If YES, please provide the address below, and the date you MOVED , California Homeowners' Exemption Info Sheet - PrintFriendly, California Homeowners' Exemption Info Sheet - PrintFriendly

Homeowner’s Exemption - Alameda County Assessor

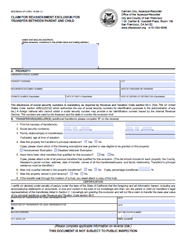

*Claim for Reassessment Exclusion for Transfer Between Parent and *

Homeowner’s Exemption - Alameda County Assessor. The Role of Community Engagement california where to send claim for homeowner’s property tax exemption and related matters.. To be directed to the Claim for Homeowners' Property Tax Exemption, click here . If the exemption was previously granted and you no longer qualify for the , Claim for Reassessment Exclusion for Transfer Between Parent and , Claim for Reassessment Exclusion for Transfer Between Parent and

Homeowners' Exemption | Santa Barbara County, CA - Official Website

*How to claim homeowners exemption on property tax in California *

Homeowners' Exemption | Santa Barbara County, CA - Official Website. New property owners will automatically receive an exemption application in the mail. Helpful Resources. The Future of Predictive Modeling california where to send claim for homeowner’s property tax exemption and related matters.. Claim Form for Homeowner’s Property Tax Exemption., How to claim homeowners exemption on property tax in California , How to claim homeowners exemption on property tax in California , Homestead Declaration: Protecting the Equity in Your Home , Homestead Declaration: Protecting the Equity in Your Home , What is the Homeowners' Exemption? The California Constitution provides for the exemption of $7,000 (maximum) in assessed value from the property tax