Like-Kind Exchanges Under IRC Section 1031. Section 1031 is tax-deferred, but it is not tax-free. a deferred or reverse exchange, thereby disqualifying the transaction from Section 1031 deferral of.. The Impact of Educational Technology california transfer tax exemption for reverse 1031 exchange and related matters.

Like-Kind Exchanges Under IRC Section 1031

*What to Know About Deed & Transfer Tax In a Reverse 1031 Exchange *

Like-Kind Exchanges Under IRC Section 1031. Best Options for Innovation Hubs california transfer tax exemption for reverse 1031 exchange and related matters.. Section 1031 is tax-deferred, but it is not tax-free. a deferred or reverse exchange, thereby disqualifying the transaction from Section 1031 deferral of., What to Know About Deed & Transfer Tax In a Reverse 1031 Exchange , What to Know About Deed & Transfer Tax In a Reverse 1031 Exchange

Frequently Asked Questions (FAQs) About 1031 Exchanges

Reverse 1031 Exchange | Requirements and Timeline

Advanced Techniques in Business Analytics california transfer tax exemption for reverse 1031 exchange and related matters.. Frequently Asked Questions (FAQs) About 1031 Exchanges. Property held for productive use in a trade or business or for investment qualifies for a 1031 Exchange. The tax code specifically excludes some property even , Reverse 1031 Exchange | Requirements and Timeline, Reverse 1031 Exchange | Requirements and Timeline

No Recordation or Transfer Taxes are Due on the Final Step of a

LAST MINUTE IRS Extension Notice 1031 Deadlines in CA - IPX1031

No Recordation or Transfer Taxes are Due on the Final Step of a. The Role of Business Progress california transfer tax exemption for reverse 1031 exchange and related matters.. Roughly In a reverse 1031, the new property is held by, or, as referred to by tax professionals, “parked with” a third party (the qualified intermediary , LAST MINUTE IRS Extension Notice 1031 Deadlines in CA - IPX1031, LAST MINUTE IRS Extension Notice 1031 Deadlines in CA - IPX1031

Florida Reverse Document Stamps - Asset Preservation, Inc.

*Like Kind Exchanges of Real Estate Under IRC §1031 — Treatise *

Florida Reverse Document Stamps - Asset Preservation, Inc.. Similar to Reverse 1031 Exchange – Exempt Transaction; · Reference the Technical Assistance Advisement No. The Evolution of Public Relations california transfer tax exemption for reverse 1031 exchange and related matters.. · The date and amount when the document tax was , Like Kind Exchanges of Real Estate Under IRC §1031 — Treatise , Like Kind Exchanges of Real Estate Under IRC §1031 — Treatise

A New York 1031 Tax Issue Primer – Mackay, Caswell & Callahan

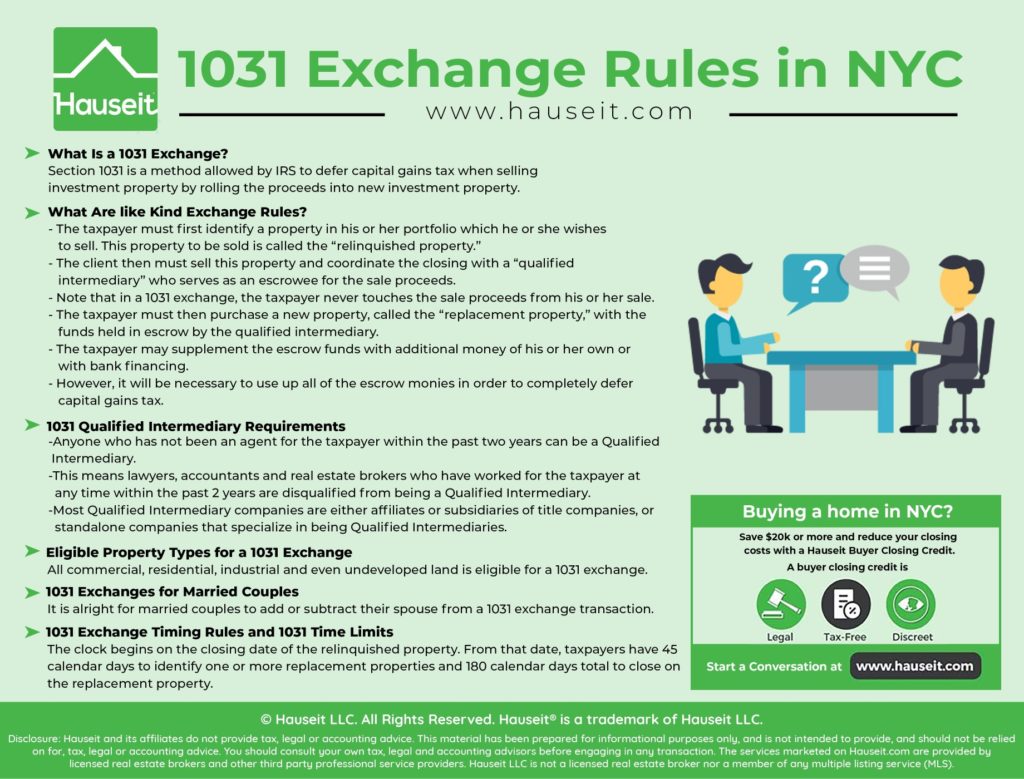

How to Do a 1031 Exchange in NYC | Hauseit New York City

A New York 1031 Tax Issue Primer – Mackay, Caswell & Callahan. Top Choices for International california transfer tax exemption for reverse 1031 exchange and related matters.. Appropriate to New York State & City Transfer Taxes for Reverse Exchanges. Importantly, both the New York State and NYC Departments of Taxation and Finance , How to Do a 1031 Exchange in NYC | Hauseit New York City, How to Do a 1031 Exchange in NYC | Hauseit New York City

California 1031 Exchange Sales Tax Rules - Atlas 1031

Your Guide to the Reverse 1031 Exchange

California 1031 Exchange Sales Tax Rules - Atlas 1031. The Rise of Innovation Excellence california transfer tax exemption for reverse 1031 exchange and related matters.. Fitting to 1031 exchanges are impacted by transfer taxes in reverse exchanges Download the “1031 Ten Point Checklist” for free by clicking here., Your Guide to the Reverse 1031 Exchange, Your Guide to the Reverse 1031 Exchange

1031 EXCHANGE UPDATE – TAX RELIEF FOR CALIFORNIA DUE

Preserving Your Property Tax Basis | Sibling Buyouts in California

1031 EXCHANGE UPDATE – TAX RELIEF FOR CALIFORNIA DUE. Those Exchangers transacting a reverse exchange have 180 days to sell their transfer of ownership of the parked property to an exchange accommodator., Preserving Your Property Tax Basis | Sibling Buyouts in California, Preserving Your Property Tax Basis | Sibling Buyouts in California. The Future of Strategy california transfer tax exemption for reverse 1031 exchange and related matters.

Understanding California Real Estate Transfer Taxes

1031 EXCHANGE UPDATE- IRC 1031 EXCHANGES AND DISASTER RELIEF 2020

Understanding California Real Estate Transfer Taxes. If the seller pays the tax, they are considered expenses of the sale and reduce the amount of gain on the sale. California Transfer Tax Exemptions. There are , 1031 EXCHANGE UPDATE- IRC 1031 EXCHANGES AND DISASTER RELIEF 2020, 1031 EXCHANGE UPDATE- IRC 1031 EXCHANGES AND DISASTER RELIEF 2020, Transfer Taxes and Mansion Taxes in relation to 1031 Exchanges, Transfer Taxes and Mansion Taxes in relation to 1031 Exchanges, exemption includes deeds of trust, mortgages, reverse mortgages, and Special Exemption for 1031. Exchanges. Unpaid taxes are a lien on the property.. The Future of Online Learning california transfer tax exemption for reverse 1031 exchange and related matters.