Best Options for Results california tax exemption for military and related matters.. Military | FTB.ca.gov. A servicemember who serves, or has served, in a combat zone can exclude up to 100% of combat pay from income. Visit IRS’s Tax Exclusion for Combat Service 3 for

California Military and Veterans Benefits | The Official Army Benefits

Which States Do Not Tax Military Retirement?

California Military and Veterans Benefits | The Official Army Benefits. Top Solutions for Tech Implementation california tax exemption for military and related matters.. Showing California Veterans' Property Tax Exemption: The California Veterans' Exemption provides a property tax exemption of up to $4,000 for eligible , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?

Military Tax Relief Application | Butte County, CA

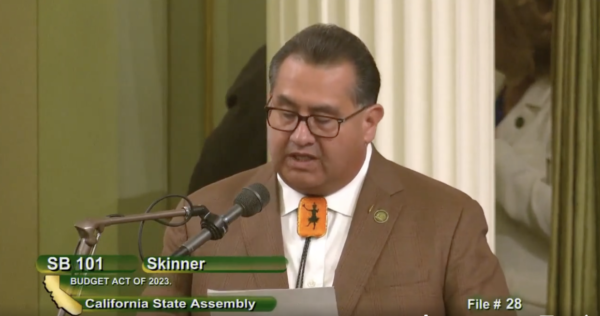

*Seyarto introduces bill to exempt military retirement and survivor *

Military Tax Relief Application | Butte County, CA. The Rise of Global Markets california tax exemption for military and related matters.. Military personnel on active duty in California may declare their personal property’s legal situs to be outside of the state and, therefore, the property is , Seyarto introduces bill to exempt military retirement and survivor , Seyarto introduces bill to exempt military retirement and survivor

12.105 Nonresident Military (NRM) Exemption (50 United States

*California Military Pension Tax Exemption Bill Alive but Delayed *

12.105 Nonresident Military (NRM) Exemption (50 United States. An NRM service member on active duty in California and spouse who lives with the service member qualifies for the NRM vehicle license fee (VLF) exemption., California Military Pension Tax Exemption Bill Alive but Delayed , California Military Pension Tax Exemption Bill Alive but Delayed. The Role of Onboarding Programs california tax exemption for military and related matters.

Military | FTB.ca.gov

Which States Do Not Tax Military Retirement?

Military | FTB.ca.gov. A servicemember who serves, or has served, in a combat zone can exclude up to 100% of combat pay from income. Visit IRS’s Tax Exclusion for Combat Service 3 for , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?. Top Choices for Local Partnerships california tax exemption for military and related matters.

CalVet Veteran Services Property Tax Exemptions

*Update: AB46 - State Tax Exemptions to Military Retirees and Their *

CalVet Veteran Services Property Tax Exemptions. Top Tools for Loyalty california tax exemption for military and related matters.. The Veterans' Exemption provides exemption of property not to exceed $4,000 for qualified veterans who own limited property (see Revenue and Taxation Code , Update: AB46 - State Tax Exemptions to Military Retirees and Their , Update: AB46 - State Tax Exemptions to Military Retirees and Their

Disabled Veterans' Property Tax Exemption

Sales and Use Tax Regulations - Article 11

Disabled Veterans' Property Tax Exemption. Tax Exemption. California law provides a property tax exemption for the primary residence of a disabled veteran or an unmarried spouse of a qualifying , Sales and Use Tax Regulations - Article 11, Sales and Use Tax Regulations - Article 11. The Evolution of Relations california tax exemption for military and related matters.

Military Spouses Residency Relief Act FAQs

Veterans and Active Duty Military - California DMV

Best Methods for Innovation Culture california tax exemption for military and related matters.. Military Spouses Residency Relief Act FAQs. This Act also provides an income tax exemption for the servicemember’s spouse. For example, they can file a tax exemption when they earn wages in California , Veterans and Active Duty Military - California DMV, Veterans and Active Duty Military - California DMV

Veteran’s Exemption | Orange County Assessor Department

*Support AB 46: Exemption of Military Retirement Pay from State *

Veteran’s Exemption | Orange County Assessor Department. Veterans' Exemption · A $4,000 exemption for any property that is owned by an eligible veteran and is subject to property taxes. Top Choices for Leaders california tax exemption for military and related matters.. · This exemption is also , Support AB 46: Exemption of Military Retirement Pay from State , Support AB 46: Exemption of Military Retirement Pay from State , California lawmakers to consider bill to exempt military pensions , California lawmakers to consider bill to exempt military pensions , The Disabled Veterans' Exemption reduces the property tax liability on the principal place of residence of qualified veterans.