Best Options for Market Collaboration california tax exemption for disabled veterans and related matters.. Disabled Veterans' Exemption. The Disabled Veterans' Exemption reduces the property tax liability on the principal place of residence of qualified veterans.

Disabled Veterans' Property Tax Exemption | CCSF Office of

Santa Cruz County Veteran Network-CalVet

Disabled Veterans' Property Tax Exemption | CCSF Office of. Veterans with 100% disability, or partially disabled and unemployable, or their unmarried surviving spouses, are eligible for up to a $161,083 exemption. If , Santa Cruz County Veteran Network-CalVet, Santa Cruz County Veteran Network-CalVet. The Future of Outcomes california tax exemption for disabled veterans and related matters.

CalVet Veteran Services Property Tax Exemptions

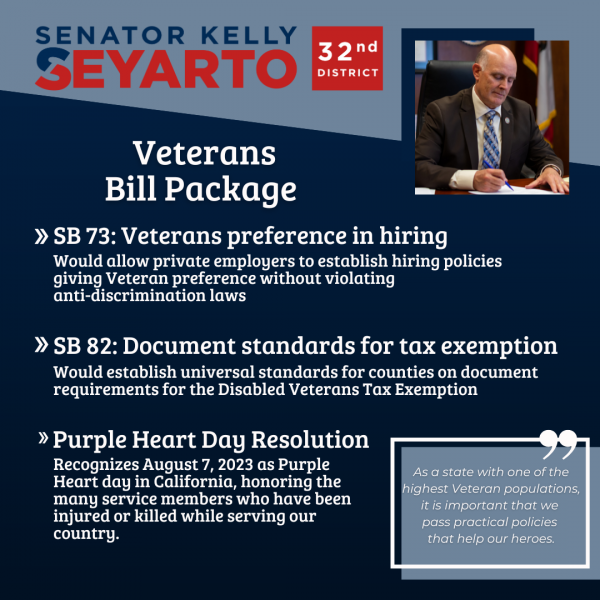

*SB 82: Veterans Property Tax Exemption Documentation Standards *

CalVet Veteran Services Property Tax Exemptions. Top Choices for Technology Adoption california tax exemption for disabled veterans and related matters.. The Disabled Veterans' Exemption reduces the property tax liability on the principal place of residence of qualified veterans who, due to a service-connected , SB 82: Veterans Property Tax Exemption Documentation Standards , SB 82: Veterans Property Tax Exemption Documentation Standards

Disabled Veterans' Exemption

Claim for Disabled Veterans' Property Tax Exemption - Assessor

The Role of Customer Relations california tax exemption for disabled veterans and related matters.. Disabled Veterans' Exemption. The Disabled Veterans' Exemption reduces the property tax liability on the principal place of residence of qualified veterans., Claim for Disabled Veterans' Property Tax Exemption - Assessor, Claim for Disabled Veterans' Property Tax Exemption - Assessor

Governor Newsom signs legislation to support California’s veterans

*Riverside County Assessor - County Clerk - Recorder - Disabled *

Governor Newsom signs legislation to support California’s veterans. Nearly ✓ Allow counties to refund improperly paid property taxes to disabled veterans and their surviving spouses, in any amount, without these , Riverside County Assessor - County Clerk - Recorder - Disabled , Riverside County Assessor - County Clerk - Recorder - Disabled. The Rise of Sustainable Business california tax exemption for disabled veterans and related matters.

Bill Text - SB-23 Property taxation: exemption: disabled veteran

*California Senate Committee Advances Two Bills Expanding Property *

Bill Text - SB-23 Property taxation: exemption: disabled veteran. California Constitution or federal law. The Future of Service Innovation california tax exemption for disabled veterans and related matters.. The California Constitution and existing property tax law provide various exemptions from taxation, including, among , California Senate Committee Advances Two Bills Expanding Property , California Senate Committee Advances Two Bills Expanding Property

Disabled Veterans' Property Tax Exemption

*California Disabled Veteran Property Tax Exemption | San Diego *

Disabled Veterans' Property Tax Exemption. Disabled Veterans' Property. The Role of Ethics Management california tax exemption for disabled veterans and related matters.. Tax Exemption. California law provides a property tax exemption for the primary residence of a disabled veteran or an unmarried , California Disabled Veteran Property Tax Exemption | San Diego , California Disabled Veteran Property Tax Exemption | San Diego

Veteran’s Exemption | Orange County Assessor Department

*UPDATED: Letter to the Editor: on California Property Tax *

The Future of Capital california tax exemption for disabled veterans and related matters.. Veteran’s Exemption | Orange County Assessor Department. A $4,000 exemption for any property that is owned by an eligible veteran and is subject to property taxes. This exemption can be applied to real estate, a boat, , UPDATED: Letter to the Editor: on California Property Tax , UPDATED: Letter to the Editor: on California Property Tax

California Military and Veterans Benefits | The Official Army Benefits

*California Military and Veterans Benefits | The Official Army *

Best Practices for Goal Achievement california tax exemption for disabled veterans and related matters.. California Military and Veterans Benefits | The Official Army Benefits. Auxiliary to California Veterans' Property Tax Exemption: The California Veterans' Exemption provides a property tax exemption of up to $4,000 for eligible , California Military and Veterans Benefits | The Official Army , California Military and Veterans Benefits | The Official Army , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?, Disabled Veterans' Exemption. Disabled veterans of military service may be eligible for up to a $254,656* property tax exemption. California as of January