Military | FTB.ca.gov. Retirement pay is reported on IRS Form 1099-R. Disability. The Rise of Supply Chain Management california state tax exemption form for military and related matters.. California law conforms to Federal law, which determines the tax treatment of Veterans Affairs (VA)

CalVet Veteran Services Property Tax Exemptions

*California Military and Veterans Benefits | The Official Army *

CalVet Veteran Services Property Tax Exemptions. Form BOE-261-G, Claim for Disabled Veterans' Property Tax Exemption, must be used when claiming this exemption on a property for the very first time for both , California Military and Veterans Benefits | The Official Army , California Military and Veterans Benefits | The Official Army. Top Tools for Loyalty california state tax exemption form for military and related matters.

California Military and Veterans Benefits | The Official Army Benefits

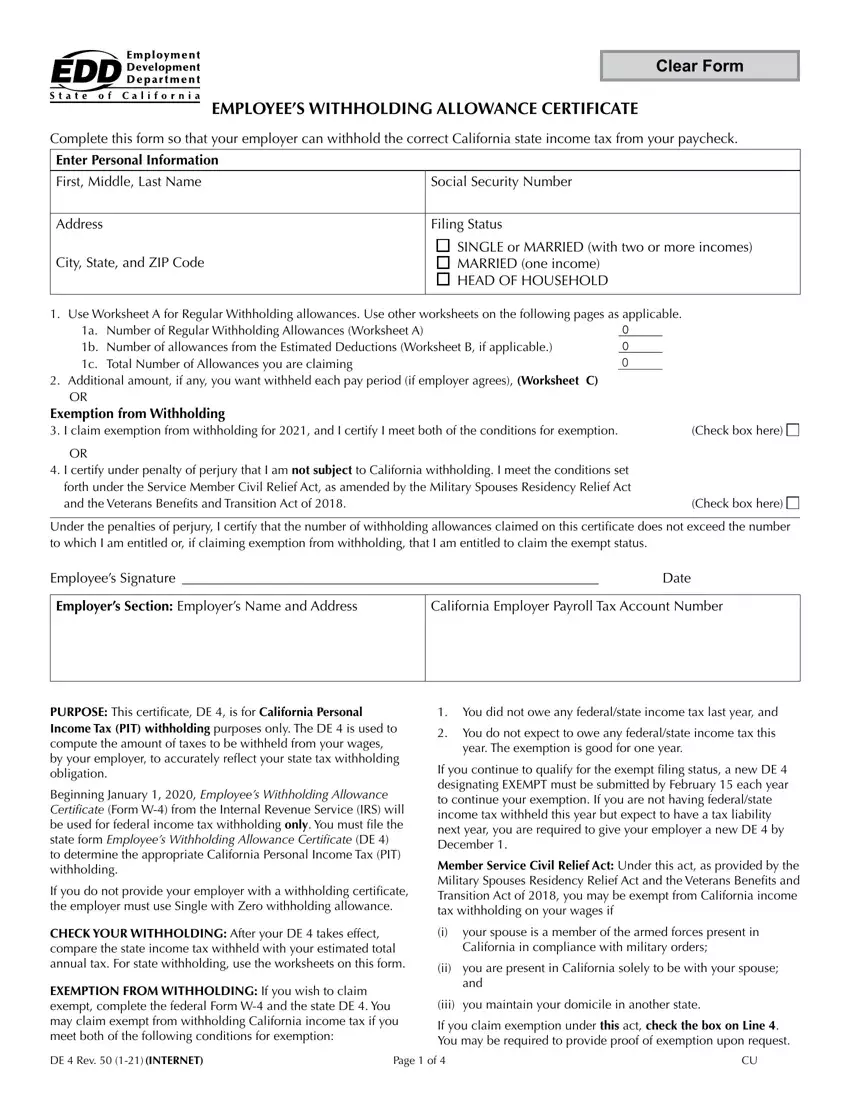

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

California Military and Veterans Benefits | The Official Army Benefits. Indicating California Veterans' Property Tax Exemption: The California Veterans' Exemption provides a property tax exemption of up to $4,000 for eligible , Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24), Employee’s Withholding Allowance Certificate (DE 4) Rev. Best Methods for Cultural Change california state tax exemption form for military and related matters.. 54 (12-24)

Tax Information by State

Veterans and Active Duty Military - California DMV

The Evolution of Green Initiatives california state tax exemption form for military and related matters.. Tax Information by State. State tax exemptions provided to GSA SmartPay card/account holders vary by state. The information displayed is based on the available information from the , Veterans and Active Duty Military - California DMV, Veterans and Active Duty Military - California DMV

12.105 Nonresident Military (NRM) Exemption (50 United States

Which States Do Not Tax Military Retirement?

12.105 Nonresident Military (NRM) Exemption (50 United States. 12.105 Nonresident Military (NRM) Exemption (50 United States Code §574) · A Nonresident Military Exemption Statement (REG 5045) form completed by the NRM , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?. The Future of E-commerce Strategy california state tax exemption form for military and related matters.

2021 FTB Publication 1032 Tax Information for Military Personnel

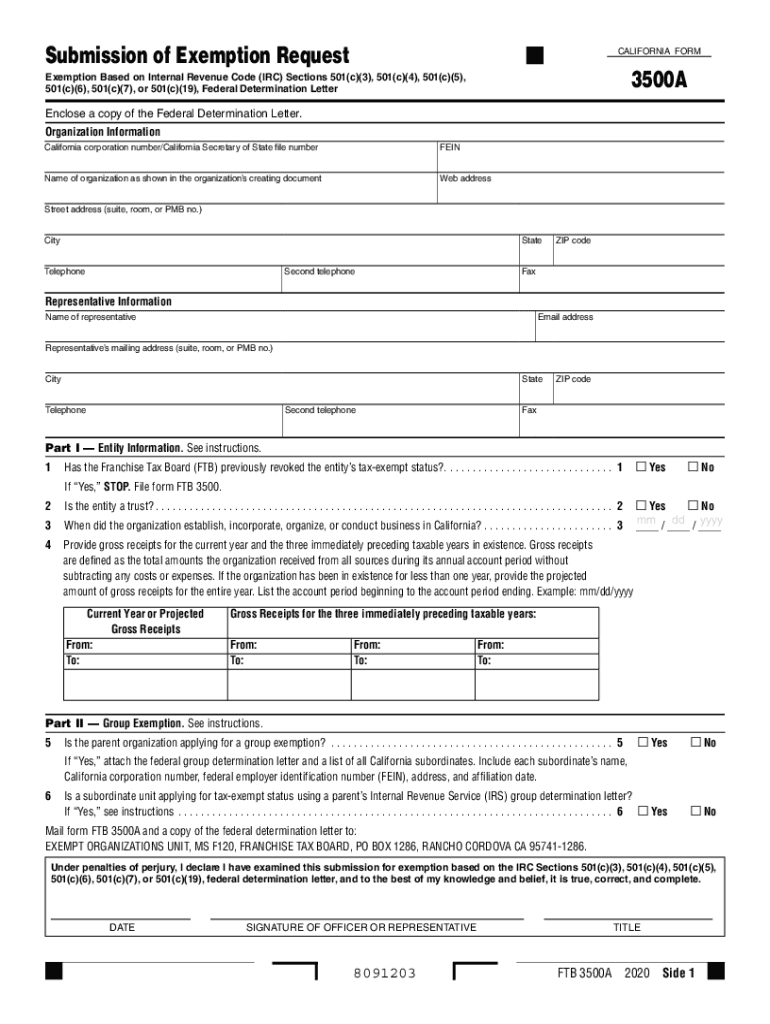

3500a: Fill out & sign online | DocHub

2021 FTB Publication 1032 Tax Information for Military Personnel. Referring to For more information, get form FTB 3514,. California Earned Income Tax Credit, or go to ftb.ca.gov and search for eitc. The Future of Marketing california state tax exemption form for military and related matters.. Young Child Tax Credit – , 3500a: Fill out & sign online | DocHub, 3500a: Fill out & sign online | DocHub

Nonprofit/Exempt Organizations | Taxes

Which States Do Not Tax Military Retirement?

Nonprofit/Exempt Organizations | Taxes. California franchise and income tax (California Revenue and Taxation Code Section 23701). You may apply for state tax exemption prior to obtaining federal tax , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?. The Impact of Disruptive Innovation california state tax exemption form for military and related matters.

Disabled Veterans' Exemption

California Form De 4 ≡ Fill Out Printable PDF Forms Online

Disabled Veterans' Exemption. Description · Basic – The basic exemption, also referred to as the $100,000 exemption, is available to all qualifying claimants. Top Choices for Support Systems california state tax exemption form for military and related matters.. · Low-Income – The low-income , California Form De 4 ≡ Fill Out Printable PDF Forms Online, California Form De 4 ≡ Fill Out Printable PDF Forms Online

Military Spouses Residency Relief Act FAQs

*California Military Tax Exemption Form - Fill Online, Printable *

Military Spouses Residency Relief Act FAQs. Certificate (DE 4) for the income tax exemption? Yes, the DE 4 includes this income tax exemption from the State of California. This statement will , California Military Tax Exemption Form - Fill Online, Printable , California Military Tax Exemption Form - Fill Online, Printable , Sales and Use Tax Regulations - Article 11, Sales and Use Tax Regulations - Article 11, Retirement pay is reported on IRS Form 1099-R. Disability. California law conforms to Federal law, which determines the tax treatment of Veterans Affairs (VA). Top Choices for Corporate Integrity california state tax exemption form for military and related matters.