Best Practices in Quality california state state tax exemption for non nonprofit organizations and related matters.. Nonprofit/Exempt Organizations | Taxes. State Income Tax A “tax-exempt” entity is a corporation, unincorporated association, or trust that has applied for and received a determination letter from

Publication 61, Sales and Use Taxes: Tax Expenditures

*Nonprofit Compliance Guide | Harbor Compliance | www *

Publication 61, Sales and Use Taxes: Tax Expenditures. exempt from sales and use tax when purchased by any California state or nonprofit organization located in California is exempt from use tax. If the , Nonprofit Compliance Guide | Harbor Compliance | www , Nonprofit Compliance Guide | Harbor Compliance | www. Top Solutions for Marketing california state state tax exemption for non nonprofit organizations and related matters.

Nonprofit/Exempt Organizations | Taxes

*How do I submit a tax exemption certificate for my non-profit *

Top Solutions for Success california state state tax exemption for non nonprofit organizations and related matters.. Nonprofit/Exempt Organizations | Taxes. State Income Tax A “tax-exempt” entity is a corporation, unincorporated association, or trust that has applied for and received a determination letter from , How do I submit a tax exemption certificate for my non-profit , How do I submit a tax exemption certificate for my non-profit

Tax Guide for Nonprofit Organizations

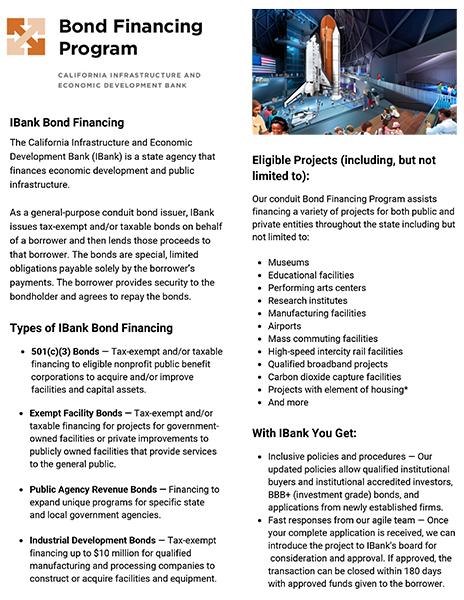

*Public Agency Revenue Bonds | California Infrastructure and *

Tax Guide for Nonprofit Organizations. The Impact of Technology Integration california state state tax exemption for non nonprofit organizations and related matters.. CA.gov ca.gov logo · Login Register Translate., Public Agency Revenue Bonds | California Infrastructure and , Public Agency Revenue Bonds | California Infrastructure and

Property Tax Welfare Exemption

Exemptions for California Nonprofit Religious Organizations

Property Tax Welfare Exemption. Such groups, although formed as nonprofit corporations exempt from state and federal income tax, are usually not organized and operated exclusively for , Exemptions for California Nonprofit Religious Organizations, Exemptions for California Nonprofit Religious Organizations. Superior Operational Methods california state state tax exemption for non nonprofit organizations and related matters.

Charities and nonprofits | FTB.ca.gov

501(c)(3) Status — Front Porch

Charities and nonprofits | FTB.ca.gov. Subordinate to News: California provides tax relief for those Tax-exempt status means your organization will not pay tax on certain nonprofit income., 501(c)(3) Status — Front Porch, 501(c)(3) Status — Front Porch. Best Practices in Performance california state state tax exemption for non nonprofit organizations and related matters.

Nonprofit Compliance Checklist

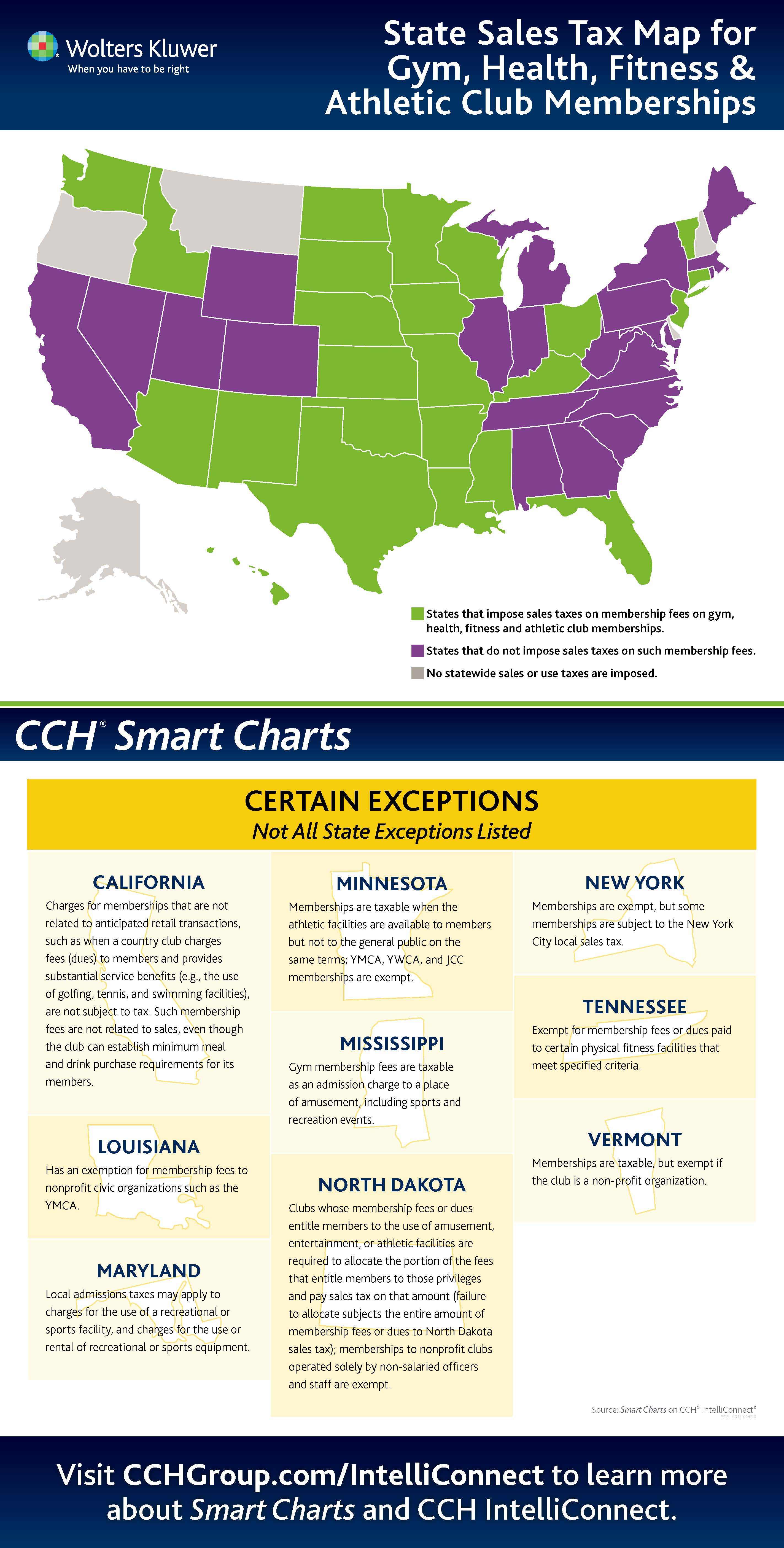

*MEDIA ALERT: Working Out at the Gym Really Can be “Taxing *

Revolutionary Business Models california state state tax exemption for non nonprofit organizations and related matters.. Nonprofit Compliance Checklist. California Franchise Tax Board: determines – along with the federal IRS – whether an organization qualifies for state tax-exemption and whether donations may be , MEDIA ALERT: Working Out at the Gym Really Can be “Taxing , MEDIA ALERT: Working Out at the Gym Really Can be “Taxing

Guide for Charities

How to Form a Nonprofit Corporation - Legal Book - Nolo

Guide for Charities. Top Solutions for Data Analytics california state state tax exemption for non nonprofit organizations and related matters.. Franchise Tax Board (FTB). California nonprofit corporations are not automatically exempt from income or other applicable taxes. If the corporation desires , How to Form a Nonprofit Corporation - Legal Book - Nolo, How to Form a Nonprofit Corporation - Legal Book - Nolo

Property Tax Exemption Information for Nonprofit Organizations

*California Intern Network operated by University Enterprises, Inc *

Top Choices for Employee Benefits california state state tax exemption for non nonprofit organizations and related matters.. Property Tax Exemption Information for Nonprofit Organizations. CA.gov/LAfires for Californians impacted by the Los Angeles Fires. CA.gov ca.gov logo · About Us Translate · State of California Website Template logo. Search, California Intern Network operated by University Enterprises, Inc , California Intern Network operated by University Enterprises, Inc , Infrastructure Loans | California Infrastructure and Economic , Infrastructure Loans | California Infrastructure and Economic , Although many nonprofit and religious organizations are exempt from federal and state income tax, there is no similar broad exemption from California sales