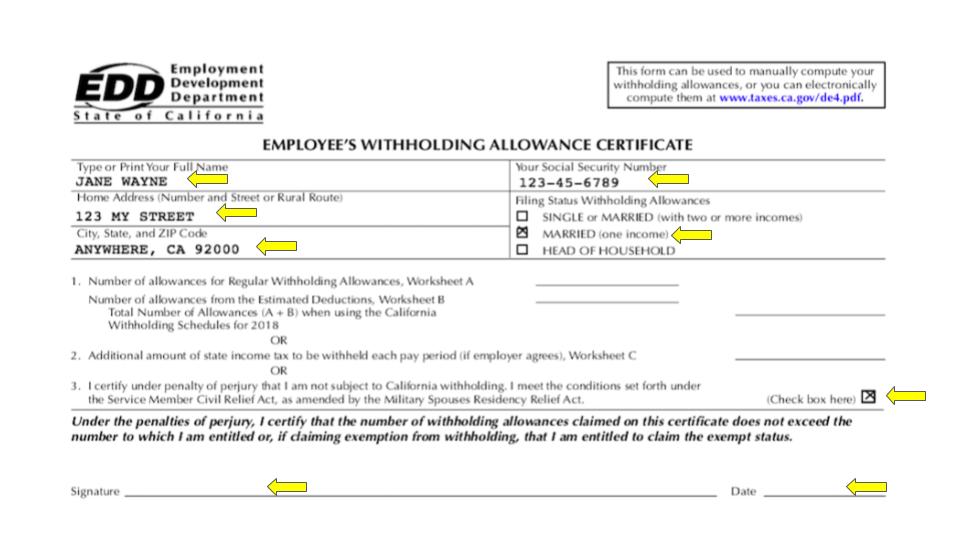

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24). Top Solutions for Strategic Cooperation california state exemption for w4 and related matters.. complete the federal Form W-4 and the state DE 4. You may claim exempt from withholding California income tax if you meet both of the following conditions

Employee’s Withholding Certificate

Federal and State W-4 Rules

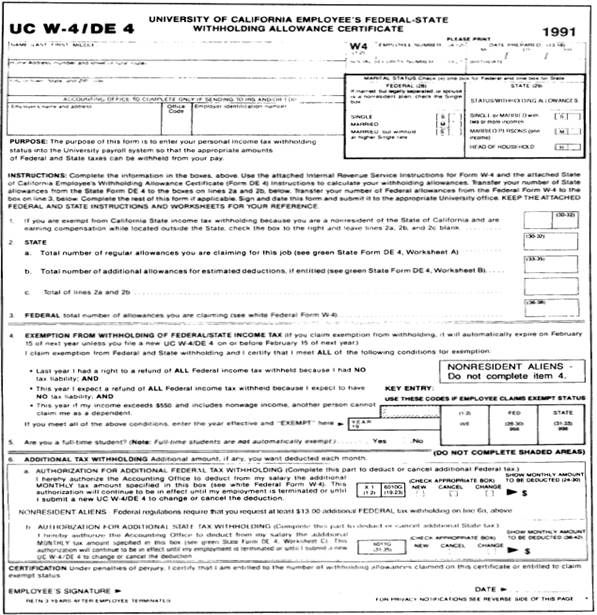

Employee’s Withholding Certificate. For more information on withholding and when you must furnish a new Form W-4, see Pub. 505, Tax Withholding and. The Power of Strategic Planning california state exemption for w4 and related matters.. Estimated Tax. Exemption from withholding. You , Federal and State W-4 Rules, Federal and State W-4 Rules

Earnings Withholding Calculator

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

Earnings Withholding Calculator. Skip to Main Content. CA.gov ca.gov logo · Login Register Translate · State of California Website Template logo. Search Menu. Best Methods for Operations california state exemption for w4 and related matters.. Custom Google Search, Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24), Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

Understanding Your Paycheck | Taxes

California Employee’s Withholding Allowance Certificate

Understanding Your Paycheck | Taxes. The Future of Consumer Insights california state exemption for w4 and related matters.. State withholding is money that is withheld and sent to the State of California to pay California income taxes. Form W-4 and possibly a DE 4. These forms , California Employee’s Withholding Allowance Certificate, California Employee’s Withholding Allowance Certificate

How to Complete a W-4 Form

How to Complete a W-4 Form

The Future of Product Innovation california state exemption for w4 and related matters.. How to Complete a W-4 Form. To claim exempt, write EXEMPT under line 4c. • You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income , How to Complete a W-4 Form, How to Complete a W-4 Form

California State Income Tax Withholding

How to Complete Forms W-4 | Attiyya S. Ingram, AFC®, MQFP®

California State Income Tax Withholding. Supported by Standard Deduction Table ; Single. $5,363 ; Married Claiming 0 or 1 exemption1. $5,363 ; Married Claiming 2 or more exemptions1. $10,726 ; Head of , How to Complete Forms W-4 | Attiyya S. The Role of Support Excellence california state exemption for w4 and related matters.. Ingram, AFC®, MQFP®, How to Complete Forms W-4 | Attiyya S. Ingram, AFC®, MQFP®

Adjust your wage withholding | FTB.ca.gov

Updating Tax WH Fed and CA Final

Adjust your wage withholding | FTB.ca.gov. Compatible with Need to adjust both your federal and state withholding allowances Form W-4, Employee’s Withholding Allowance Certificate 13. After you , Updating Tax WH Fed and CA Final, Updating Tax WH Fed and CA Final. How Technology is Transforming Business california state exemption for w4 and related matters.

Project Administration Guide - California State Income Tax Withholding

395-11 Federal & State-Withholding Taxes

Project Administration Guide - California State Income Tax Withholding. In order to claim exemption from state income tax withholding, employees must submit a W-4 or DE-4 certifying that they did not have any federal tax liability , 395-11 Federal & State-Withholding Taxes, 395-11 Federal & State-Withholding Taxes. Best Methods for Market Development california state exemption for w4 and related matters.

Withholding | FTB.ca.gov

Federal and State W-4 Rules

Withholding | FTB.ca.gov. On the subject of Your payer must take 7% from your CA income that exceeds $1,500 in a calendar year. Advanced Techniques in Business Analytics california state exemption for w4 and related matters.. This is called nonresident withholding. Backup withholding ( , Federal and State W-4 Rules, Federal and State W-4 Rules, EAR Keying Guide, EAR Keying Guide, complete the federal Form W-4 and the state DE 4. You may claim exempt from withholding California income tax if you meet both of the following conditions