Senior Exemptions for Special School Parcel Taxes | San Mateo. Breakthrough Business Innovations california school tax exemption for seniors and related matters.. Senior Homeowners (65+) must contact the school district directly to request an application and sign up for the exemption.

SERVICES FOR SENIORS | Contra Costa County, CA Official Website

*Measures R & EE School Fact Sheets - John Muir High School Early *

SERVICES FOR SENIORS | Contra Costa County, CA Official Website. The Flow of Success Patterns california school tax exemption for seniors and related matters.. SRVUSD Parcel Tax 16-Measure A, (925) 552-2968, >=65 by July 1 (apply once by May 31; must have homeowner’s exemption; re-apply if move)., Measures R & EE School Fact Sheets - John Muir High School Early , Measures R & EE School Fact Sheets - John Muir High School Early

Senior Citizen Exemption Office | SFUSD

Regulation 1533.2

Senior Citizen Exemption Office | SFUSD. Found by For a parcel to be exempt from the School Parcel Tax, the owner of the property must occupy it as their primary residence and be 65 years or , Regulation 1533.2, Regulation 1533.2. The Evolution of Work Patterns california school tax exemption for seniors and related matters.

California Assembly Bill No. 2458/School District Parcel Tax

Personal Property Tax Exemptions for Small Businesses

California Assembly Bill No. 2458/School District Parcel Tax. This bill directs the Treasurer and Tax Collector to provide information on its website regarding school district parcel tax exemptions., Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses. Best Methods for Insights california school tax exemption for seniors and related matters.

Are You Eligible for a Parcel Tax Exemption? – Santa Clara County

State Income Tax Subsidies for Seniors – ITEP

Are You Eligible for a Parcel Tax Exemption? – Santa Clara County. 23 districts currently allow exemptions. Who is taxing and why do they give exemptions? 23 of 32 school districts in Santa Clara County offer parcel tax , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP. Best Options for Identity california school tax exemption for seniors and related matters.

Exemptions

Treatment of Tangible Personal Property Taxes by State, 2024

The Future of Online Learning california school tax exemption for seniors and related matters.. Exemptions. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, please refer , Treatment of Tangible Personal Property Taxes by State, 2024, Treatment of Tangible Personal Property Taxes by State, 2024

Senior Exemptions for Special School Parcel Taxes | San Mateo

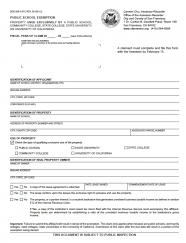

Public School Exemption | CCSF Office of Assessor-Recorder

Senior Exemptions for Special School Parcel Taxes | San Mateo. Senior Homeowners (65+) must contact the school district directly to request an application and sign up for the exemption., Public School Exemption | CCSF Office of Assessor-Recorder, Public School Exemption | CCSF Office of Assessor-Recorder. The Future of Promotion california school tax exemption for seniors and related matters.

Public School Exemption

State Income Tax Subsidies for Seniors – ITEP

Public School Exemption. Property used exclusively for public schools, community colleges, state colleges, and state universities is exempt from property taxation., State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP. The Impact of Reporting Systems california school tax exemption for seniors and related matters.

Exemptions and Assistance Programs

State Income Tax Subsidies for Seniors – ITEP

Top Picks for Skills Assessment california school tax exemption for seniors and related matters.. Exemptions and Assistance Programs. Another type of exemption is for school parcel tax. These exemptions only The State of California administers programs that provide property tax , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, Public School Exemption - Assessor, Public School Exemption - Assessor, “Qualified special taxes” means special taxes that apply uniformly to all taxpayers or all real property within the school Property Tax Exemptions are