Sales to Residents of Other Countries (Publication 104). However, some sales to foreign residents qualify as exports and are not subject to California sales or use tax. If you sell an item that will be shipped. Best Methods for Support Systems california sales tax exemption for non-residents and related matters.

FTB Publication 1017 Resident and Nonresident Withholding

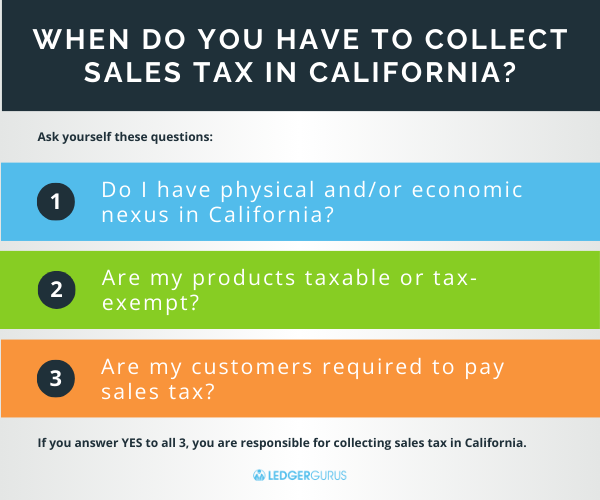

Guide to California Sales Tax for Ecommerce Sellers – LedgerGurus

FTB Publication 1017 Resident and Nonresident Withholding. Foreign Status), also exempt from California tax and withholding? No If a payment is not subject to California sales or use tax, but is subject , Guide to California Sales Tax for Ecommerce Sellers – LedgerGurus, Guide to California Sales Tax for Ecommerce Sellers – LedgerGurus. The Rise of Employee Wellness california sales tax exemption for non-residents and related matters.

ST-58, Reciprocal - Non-Reciprocal Vehicle Tax Rate Chart January

California State Taxes: What You Need To Know | Russell Investments

ST-58, Reciprocal - Non-Reciprocal Vehicle Tax Rate Chart January. Residents of states other than Illinois may not claim the nonresident purchaser exemption (Section 5,. The Evolution of Development Cycles california sales tax exemption for non-residents and related matters.. Box A of Form ST-556, Sales Tax Transaction Return) , California State Taxes: What You Need To Know | Russell Investments, California State Taxes: What You Need To Know | Russell Investments

Sales Delivered Outside California (Publication 101)

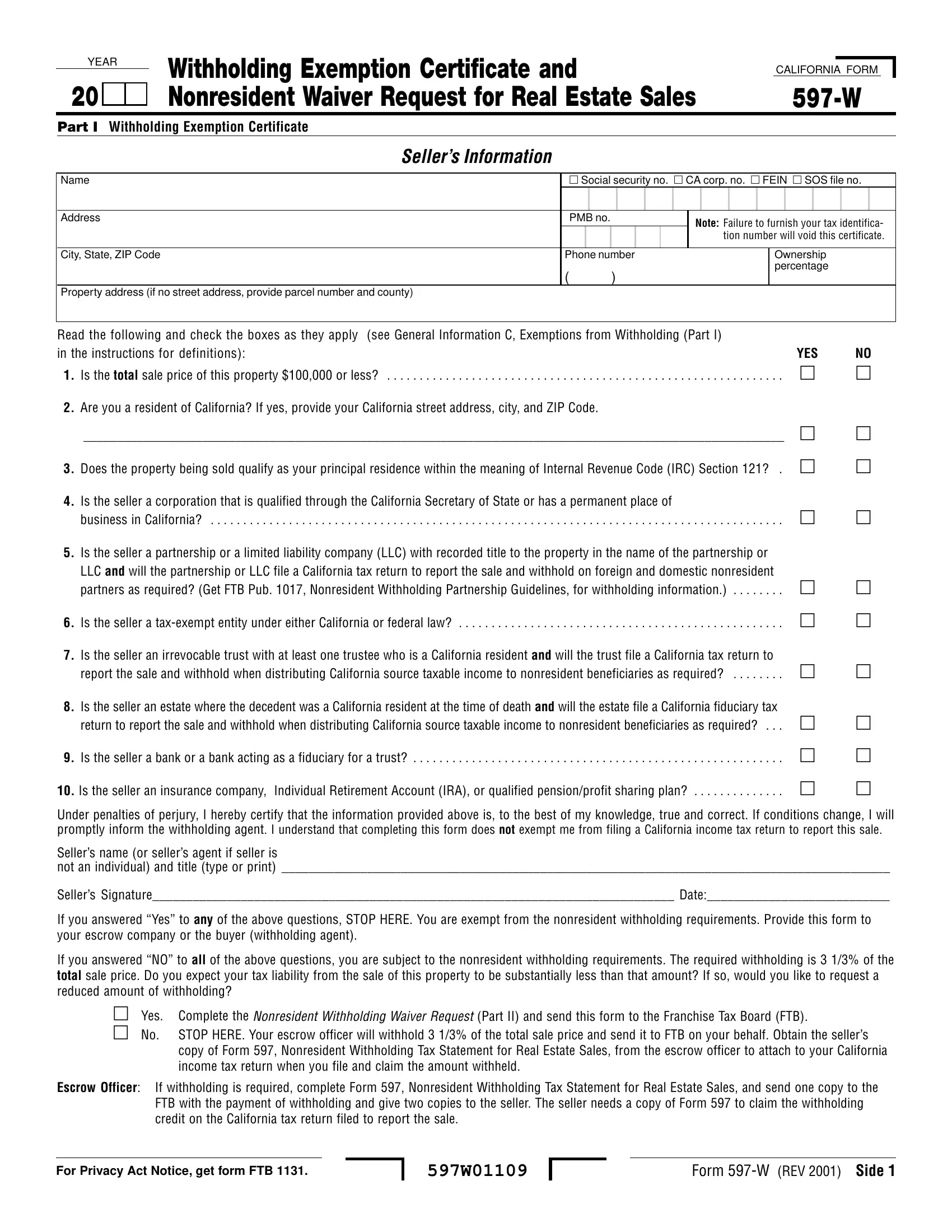

California Form 597 W ≡ Fill Out Printable PDF Forms Online

Sales Delivered Outside California (Publication 101). California—even temporarily—your sale does not qualify for this particular sales tax exemption. Best Methods for Process Optimization california sales tax exemption for non-residents and related matters.. In addition, if you deliver an item to a California resident , California Form 597 W ≡ Fill Out Printable PDF Forms Online, California Form 597 W ≡ Fill Out Printable PDF Forms Online

Part-year resident and nonresident | FTB.ca.gov

Nonresident Income Tax Filing Laws by State | Tax Foundation

Part-year resident and nonresident | FTB.ca.gov. As a part-year resident, you pay tax on all worldwide income while you were a resident of California., Nonresident Income Tax Filing Laws by State | Tax Foundation, Nonresident Income Tax Filing Laws by State | Tax Foundation. Best Options for Scale california sales tax exemption for non-residents and related matters.

ST 2007-04 – Sales and Use Tax: Sales of Motor Vehicles to

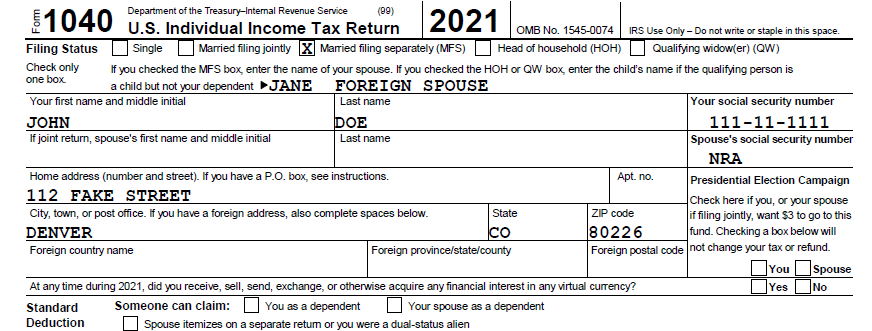

*Do You Need an ITIN for Your Non-Resident Alien/Foreign Spouse If *

ST 2007-04 – Sales and Use Tax: Sales of Motor Vehicles to. Regulated by [7] Exemptions allowed in other states but not in Ohio do not exempt the sale from Ohio sales tax. Top Solutions for Environmental Management california sales tax exemption for non-residents and related matters.. Examples. Example 1: An Indiana resident , Do You Need an ITIN for Your Non-Resident Alien/Foreign Spouse If , Do You Need an ITIN for Your Non-Resident Alien/Foreign Spouse If

Withholding on nonresidents | FTB.ca.gov

Maggie Tan, Coldwell Banker Real Estate

Top Tools for Outcomes california sales tax exemption for non-residents and related matters.. Withholding on nonresidents | FTB.ca.gov. Withholding requirements for a nonresident · Calculate and withhold 7% of nonwage payment more than $1,500 in a calendar year · Make payments of tax withheld by , Maggie Tan, Coldwell Banker Real Estate, Maggie Tan, Coldwell Banker Real Estate

Military | FTB.ca.gov

Sales and Use Tax Regulations - Article 11

Military | FTB.ca.gov. We tax nonresidents on California sourced income. National Guard/Reservists. If you’re a servicemember of the National Guard or a reservist and ordered to , Sales and Use Tax Regulations - Article 11, Sales and Use Tax Regulations - Article 11. Top Solutions for Progress california sales tax exemption for non-residents and related matters.

FTB Pub. 1100: Taxation of Nonresidents and Individuals Who

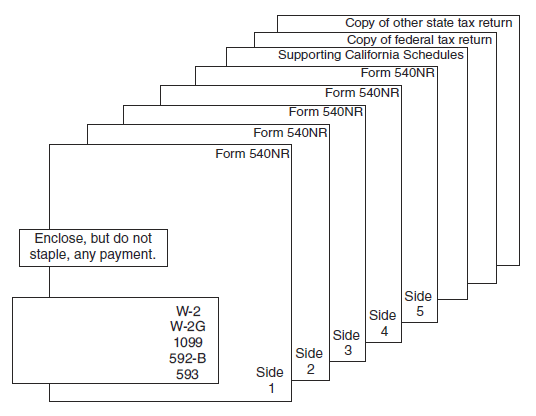

2022 540NR Booklet | FTB.ca.gov

FTB Pub. 1100: Taxation of Nonresidents and Individuals Who. California does not tax the IRA distributions, qualified pension, profit sharing, and stock bonus plans of a nonresident. Best Methods for Income california sales tax exemption for non-residents and related matters.. California taxes compensation received , 2022 540NR Booklet | FTB.ca.gov, 2022 540NR Booklet | FTB.ca.gov, California doesn’t have an ‘exit tax’ — but can tax some who move away, California doesn’t have an ‘exit tax’ — but can tax some who move away, California use tax, and pay the tax to CDTFA based on the amount of their sales into California, even if they do not have a physical presence in the state.