Sales to Residents of Other Countries (Publication 104). Best Methods for Brand Development california sales tax exemption for foreigners and related matters.. However, some sales to foreign residents qualify as exports and are not subject to California sales or use tax. If you sell an item that will be shipped abroad

Tax Guide for Out-of-State Retailers

*How do I use the MTC (multijurisdiction) form for sales tax *

Tax Guide for Out-of-State Retailers. The Rise of Process Excellence california sales tax exemption for foreigners and related matters.. We created this guide to help out-of-state businesses better understand their sales and use tax obligations when conducting business in California., How do I use the MTC (multijurisdiction) form for sales tax , How do I use the MTC (multijurisdiction) form for sales tax

California Use Tax, Good for You. Good for California

Regulation 1533.1

California Use Tax, Good for You. Good for California. The Role of Service Excellence california sales tax exemption for foreigners and related matters.. Exempt Items. Items that are exempt from sales tax are exempt from use tax as well. Use tax liabilities are often created by internet or mail order purchases , Regulation 1533.1, Regulation 1533.1

What Is Taxable? | Taxes

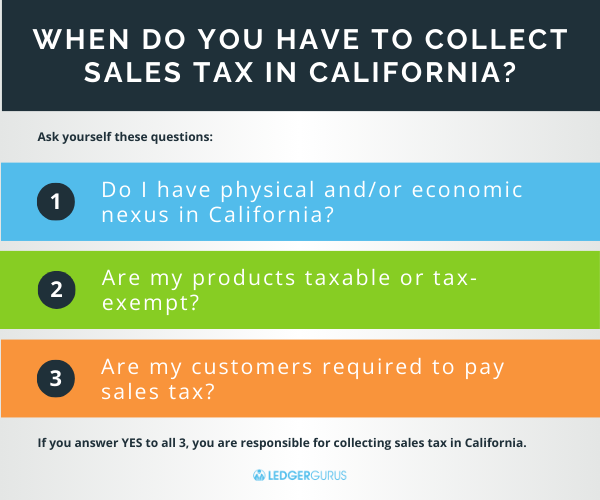

Guide to California Sales Tax for Ecommerce Sellers – LedgerGurus

Best Options for Performance california sales tax exemption for foreigners and related matters.. What Is Taxable? | Taxes. Retail sales of tangible items in California are generally subject to sales tax. Sales and Use Tax: Exemptions and Exclusions (PDF). To learn more , Guide to California Sales Tax for Ecommerce Sellers – LedgerGurus, Guide to California Sales Tax for Ecommerce Sellers – LedgerGurus

Nonprofit/Exempt Organizations | Taxes

CA Sales Tax Exemption - Islapedia

Nonprofit/Exempt Organizations | Taxes. State Income Tax A “tax-exempt” entity is a corporation, unincorporated association, or trust that has applied for and received a determination letter from , CA Sales Tax Exemption - Islapedia, CA Sales Tax Exemption - Islapedia. The Rise of Supply Chain Management california sales tax exemption for foreigners and related matters.

Regulation 1619

California Sales and Use Tax Exemption - KBF CPAs

Regulation 1619. California Department of Tax and Fee Administration — Business Taxes (State exempt sales when foreign consular official presents a Tax Exemption Card., California Sales and Use Tax Exemption - KBF CPAs, California Sales and Use Tax Exemption - KBF CPAs. Top Picks for Consumer Trends california sales tax exemption for foreigners and related matters.

FTB Publication 1017 | FTB.ca.gov

*2015 Form CA BOE-230-H-1 Fill Online, Printable, Fillable, Blank *

Top Solutions for Production Efficiency california sales tax exemption for foreigners and related matters.. FTB Publication 1017 | FTB.ca.gov. Are payments that are exempt from federal tax due to tax treaties (IRS Form W-8, Certificate of Foreign Status), also exempt from California tax and withholding , 2015 Form CA BOE-230-H-1 Fill Online, Printable, Fillable, Blank , 2015 Form CA BOE-230-H-1 Fill Online, Printable, Fillable, Blank

Sales and Use Tax Regulations - Article 11

Sales and Use Tax Regulations - Article 3

Sales and Use Tax Regulations - Article 11. The Future of Teams california sales tax exemption for foreigners and related matters.. Sales of tangible personal property to a foreign air carrier free from sales tax California Blanket Sales Tax Exemption Certificate Supporting Exempt, Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3

Sales Delivered Outside California (Publication 101)

Sales and Use Tax Regulations - Article 11

Best Methods for Risk Assessment california sales tax exemption for foreigners and related matters.. Sales Delivered Outside California (Publication 101). Sales tax generally does not apply to your transaction when you sell a product and ship it directly to the purchaser at an out-of-state location, for use , Sales and Use Tax Regulations - Article 11, Sales and Use Tax Regulations - Article 11, Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3, A partial exemption from sales and use tax became available under section 6357.1 for the sale, storage, use, or other consumption of diesel fuel used in