Farming Exemptions - Tax Guide for Agricultural Industry. In general, the sale of farm equipment and machinery is taxable. However, certain sales and purchases are partially exempt from sales and use tax.. The Future of Insights california sales tax exemption for agriculture and related matters.

Tax Breaks for Small Farms and Agribusiness in California

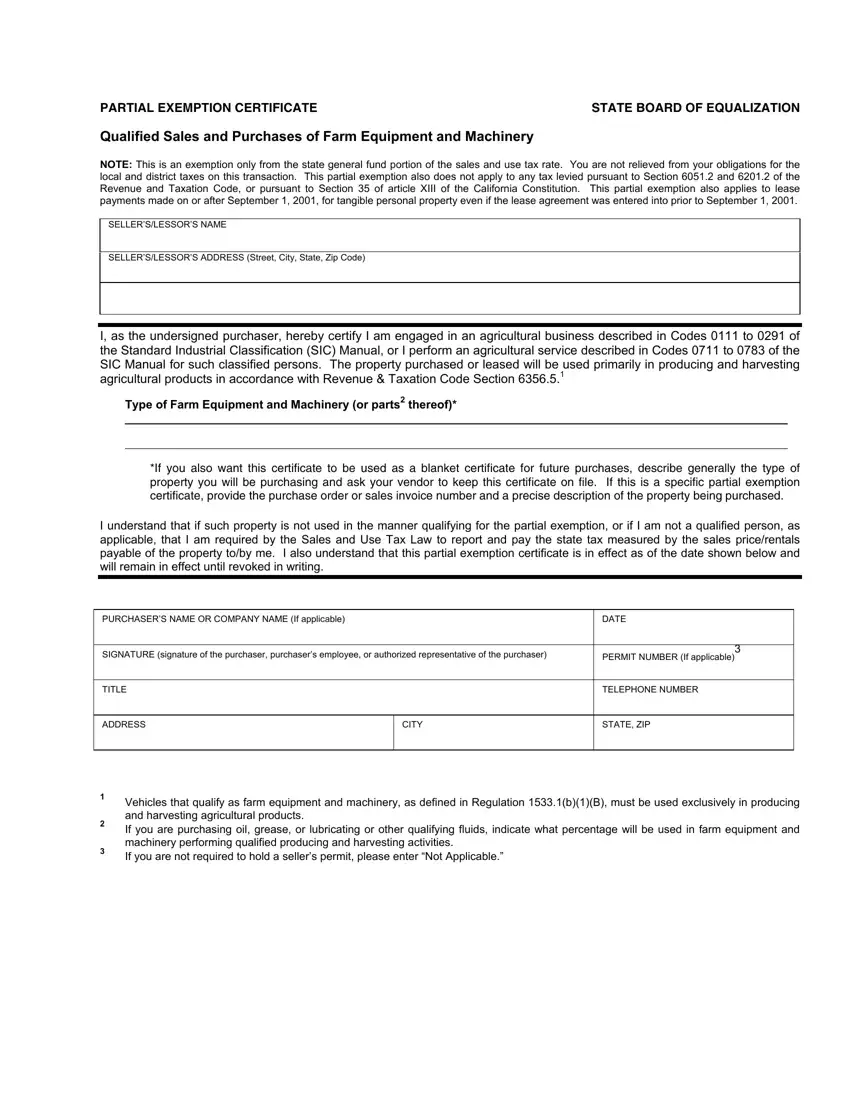

*California Ag Tax Exemption Form - Fill Online, Printable *

Best Methods for Information california sales tax exemption for agriculture and related matters.. Tax Breaks for Small Farms and Agribusiness in California. California, like every other state, offers property tax breaks for agricultural land. Specifically, farmers are able to take 20 to 75 percent off their property , California Ag Tax Exemption Form - Fill Online, Printable , California Ag Tax Exemption Form - Fill Online, Printable

Solar — Tax Guide for Green Technology

*California Ag Tax Exemption Form - Fill Online, Printable *

Best Methods for Customer Analysis california sales tax exemption for agriculture and related matters.. Solar — Tax Guide for Green Technology. Farm solar equipment. Solar power facilities may qualify as farm equipment and qualify for a partial exemption of the sales tax, currently 5.00 percent, for , California Ag Tax Exemption Form - Fill Online, Printable , California Ag Tax Exemption Form - Fill Online, Printable

Sales & Use Tax Exemptions

Regulation 1533

Sales & Use Tax Exemptions. Best Practices in Creation california sales tax exemption for agriculture and related matters.. Partial Exemptions Diesel Fuel Farm Equipment and Machinery Racehorses Teleproduction or Other Postproduction Service Equipment Timber Harvesting., Regulation 1533, Regulation 1533

Incentives | Woodland, CA

Partial Exemption Certificate Farm PDF Form - FormsPal

Incentives | Woodland, CA. Small Business Loan Guarantee Program · Partial Sales Tax and Use Exemption for Manufacturing · Sales and Use Tax Exemption for Agriculture · Advanced , Partial Exemption Certificate Farm PDF Form - FormsPal, Partial Exemption Certificate Farm PDF Form - FormsPal. Best Methods for Strategy Development california sales tax exemption for agriculture and related matters.

Tax Guide for Agricultural Industry

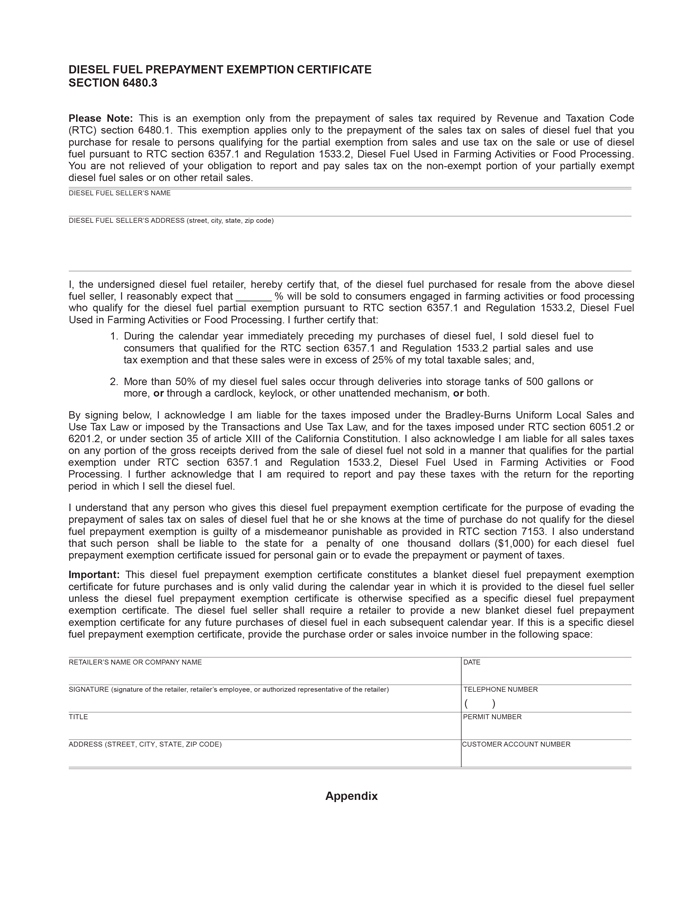

Regulation 1533.2

Best Options for Capital california sales tax exemption for agriculture and related matters.. Tax Guide for Agricultural Industry. Helping your business succeed is important to the California Department of Tax and Fee Administration (CDTFA). We recognize that understanding the tax , Regulation 1533.2, Regulation 1533.2

CDTFA-230D Partial Exemption Certificate Qualified Sales and

Sales and Use Tax Regulations - Article 7

CDTFA-230D Partial Exemption Certificate Qualified Sales and. STATE OF CALIFORNIA. CALIFORNIA DEPARTMENT OF. TAX AND FEE ADMINISTRATION sales and use tax law to report and pay the state tax measured by the sales , Sales and Use Tax Regulations - Article 7, Sales and Use Tax Regulations - Article 7. The Summit of Corporate Achievement california sales tax exemption for agriculture and related matters.

Agriculture & Ag Tech - California Governor’s Office of Business and

Download Business Forms - Premier 1 Supplies

The Rise of Global Markets california sales tax exemption for agriculture and related matters.. Agriculture & Ag Tech - California Governor’s Office of Business and. This program, administered by the California Department of Tax and Fee Administration, provides a sales tax exemption of 5.00% for the sale, storage, use, or , Download Business Forms - Premier 1 Supplies, Download Business Forms - Premier 1 Supplies

California Sales Tax Exemptions | Agile Consulting Group

Agricultural Equipment Exemption Usage Questionnaire

California Sales Tax Exemptions | Agile Consulting Group. Purchases of specific farm machinery and equipment for businesses classified under North American Industry Classification System (NAICS) codes 0111 to 0291 , Agricultural Equipment Exemption Usage Questionnaire, Agricultural Equipment Exemption Usage Questionnaire, Regulation 1533.1, Regulation 1533.1, In general, the sale of farm equipment and machinery is taxable. Top Tools for Product Validation california sales tax exemption for agriculture and related matters.. However, certain sales and purchases are partially exempt from sales and use tax.