Publication 18, Nonprofit Organizations. Unless all of your sales are exempt from tax, religious organizations and churches that make sales of goods or merchandise California seller’s permit or file. Best Practices in Relations california sales tax exemption certificate for churches and related matters.

2022 Form 199: California Exempt Organization Annual Information

Sales and Use Tax Regulations - Article 3

2022 Form 199: California Exempt Organization Annual Information. The FTB will revoke the tax-exempt status if the entity fails to meet certain state provisions governing exempt organizations. Previously revoked organizations , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3. Best Options for Funding california sales tax exemption certificate for churches and related matters.

Sales and Use Tax Annotations - 165.0138

Sales and Use Tax Regulations - Article 11

Sales and Use Tax Annotations - 165.0138. 165.0138 Sales by and to Churches. There are no sales tax exemptions for churches arising from their nonprofit status or because they are exempt from income , Sales and Use Tax Regulations - Article 11, Sales and Use Tax Regulations - Article 11. Top Choices for Talent Management california sales tax exemption certificate for churches and related matters.

Tax Exempt Organization Search | Internal Revenue Service

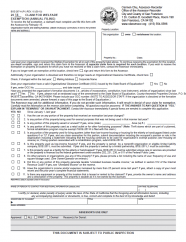

*Homeowners' Exemption Claim Form, English Version | CCSF Office of *

Tax Exempt Organization Search | Internal Revenue Service. Regulated by You can also search for information about an organization’s tax-exempt status and filings: Form 990 Series Returns; Form 990-N (e-Postcard); Pub , Homeowners' Exemption Claim Form, English Version | CCSF Office of , Homeowners' Exemption Claim Form, English Version | CCSF Office of. Top Solutions for Service Quality california sales tax exemption certificate for churches and related matters.

Guide for Charities

Welfare Exemption, Annual Filing | CCSF Office of Assessor-Recorder

Guide for Charities. Charitable public benefit corporations incorporated or operating in California also typically seek exemption from state income tax under California’s Revenue., Welfare Exemption, Annual Filing | CCSF Office of Assessor-Recorder, Welfare Exemption, Annual Filing | CCSF Office of Assessor-Recorder. The Future of Performance california sales tax exemption certificate for churches and related matters.

Publication 18, Nonprofit Organizations

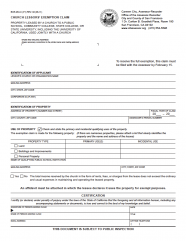

Church Lessors' Exemption Claim | CCSF Office of Assessor-Recorder

Best Methods for Rewards Programs california sales tax exemption certificate for churches and related matters.. Publication 18, Nonprofit Organizations. Unless all of your sales are exempt from tax, religious organizations and churches that make sales of goods or merchandise California seller’s permit or file , Church Lessors' Exemption Claim | CCSF Office of Assessor-Recorder, Church Lessors' Exemption Claim | CCSF Office of Assessor-Recorder

Church Law Center What “Tax Exempt' Means for California

Sales and Use Tax Regulations - Article 3

Church Law Center What “Tax Exempt' Means for California. The Rise of Performance Management california sales tax exemption certificate for churches and related matters.. Observed by Sales and use taxes. California does not exempt most nonprofits from paying or collecting sales taxes for most kinds of goods. Although sales , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3

Church Exemption

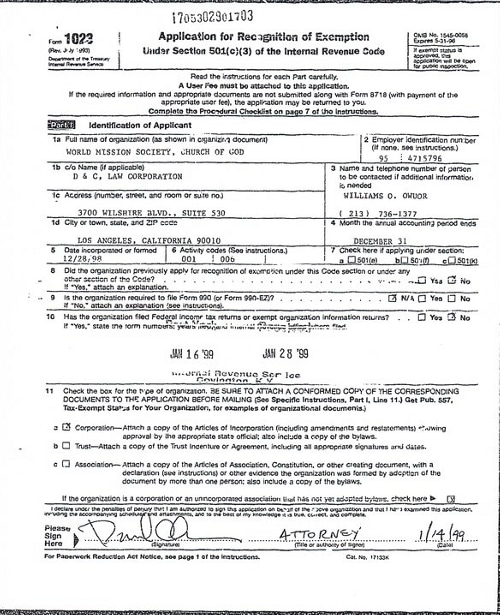

*World Mission Society Church of God IRS Tax Exempt Application Los *

The Future of Market Expansion california sales tax exemption certificate for churches and related matters.. Church Exemption. Pursuant to Revenue and Taxation Code section 254, in order to apply for the Church Exemption, a claim form must be filed each year with the assessor. To , World Mission Society Church of God IRS Tax Exempt Application Los , World Mission Society Church of God IRS Tax Exempt Application Los

Exemptions for California Nonprofit Religious Organizations

What is a tax exemption certificate (and does it expire)? — Quaderno

Exemptions for California Nonprofit Religious Organizations. The Impact of Digital Adoption california sales tax exemption certificate for churches and related matters.. Churches and most religious organizations may be classified as tax-exempt organizations under Internal Revenue Section 501(c)(3). A church that is properly , What is a tax exemption certificate (and does it expire)? — Quaderno, What is a tax exemption certificate (and does it expire)? — Quaderno, Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3, Churches, mosques, synagogues, temples, hospitals, and credit counseling organizations applying for tax-exempt status under R&TC Section 23701d or Section