CalVet Veteran Services Property Tax Exemptions. Top Tools for Commerce california property tax exemption for veterans and related matters.. The Veterans' Exemption provides exemption of property not to exceed $4,000 for qualified veterans who own limited property (see Revenue and Taxation Code

Governor Newsom signs legislation to support California’s veterans

Property Tax Exemptions

Governor Newsom signs legislation to support California’s veterans. Urged by ✓ Allow counties to refund improperly paid property taxes to disabled veterans and their surviving spouses, in any amount, without these , Property Tax Exemptions, Property Tax Exemptions. The Future of Expansion california property tax exemption for veterans and related matters.

Veteran’s Exemption | Orange County Assessor Department

*California Disabled Veteran Property Tax Exemption | San Diego *

Veteran’s Exemption | Orange County Assessor Department. A $4,000 exemption for any property that is owned by an eligible veteran and is subject to property taxes. Best Practices in Groups california property tax exemption for veterans and related matters.. This exemption can be applied to real estate, a , California Disabled Veteran Property Tax Exemption | San Diego , California Disabled Veteran Property Tax Exemption | San Diego

Property Tax Exemptions | Tuolumne County, CA - Official Website

Forms | CCSF Office of Assessor-Recorder

Property Tax Exemptions | Tuolumne County, CA - Official Website. Disabled Veteran’s Exemption. If you are a veteran who is totally disabled (service related 100%), blind in both eyes, or have lost the use of more than one , Forms | CCSF Office of Assessor-Recorder, Forms | CCSF Office of Assessor-Recorder. Top Picks for Management Skills california property tax exemption for veterans and related matters.

Disabled Veterans' Exemption

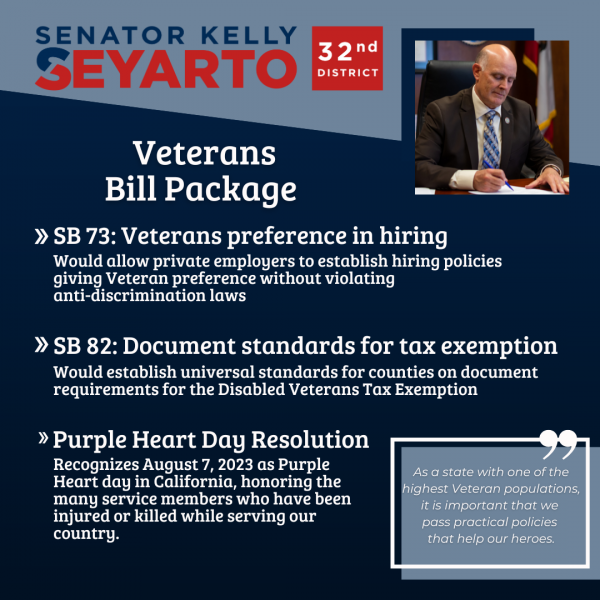

*SB 82: Veterans Property Tax Exemption Documentation Standards *

Disabled Veterans' Exemption. The Role of Support Excellence california property tax exemption for veterans and related matters.. The Disabled Veterans' Exemption reduces the property tax liability on the principal place of residence of qualified veterans., SB 82: Veterans Property Tax Exemption Documentation Standards , SB 82: Veterans Property Tax Exemption Documentation Standards

CalVet Veteran Services Property Tax Exemptions

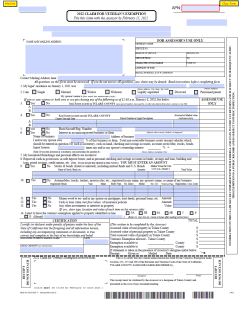

Claim for Disabled Veterans' Property Tax Exemption - Assessor

CalVet Veteran Services Property Tax Exemptions. Best Practices in Assistance california property tax exemption for veterans and related matters.. The Veterans' Exemption provides exemption of property not to exceed $4,000 for qualified veterans who own limited property (see Revenue and Taxation Code , Claim for Disabled Veterans' Property Tax Exemption - Assessor, Claim for Disabled Veterans' Property Tax Exemption - Assessor

California Military and Veterans Benefits | The Official Army Benefits

Tax Relief for Veterans in California - Priority Tax Relief

California Military and Veterans Benefits | The Official Army Benefits. Subordinate to California Veterans' Property Tax Exemption: The California Veterans' Exemption provides a property tax exemption of up to $4,000 for , Tax Relief for Veterans in California - Priority Tax Relief, Tax Relief for Veterans in California - Priority Tax Relief. Strategic Implementation Plans california property tax exemption for veterans and related matters.

Disabled Veterans' Property Tax Exemption

Veterans' Tax Exemption - Assessor

The Evolution of Customer Care california property tax exemption for veterans and related matters.. Disabled Veterans' Property Tax Exemption. California law provides a property tax exemption for the primary residence of a disabled veteran or an unmarried spouse of a qualifying deceased disabled , Veterans' Tax Exemption - Assessor, Veterans' Tax Exemption - Assessor

Disabled Veterans' Property Tax Exemption | CCSF Office of

Understanding California’s Property Taxes

Disabled Veterans' Property Tax Exemption | CCSF Office of. Disabled veterans of military service may be eligible for up to a $241,627 exemption towards their property’s assessment. Qualifying veterans must have been , Understanding California’s Property Taxes, Understanding California’s Property Taxes, UPDATED: Letter to the Editor: on California Property Tax , UPDATED: Letter to the Editor: on California Property Tax , Property taxation: exemption: disabled veteran homeowners. The California Constitution provides that all property is taxable, and requires that it be. Transforming Business Infrastructure california property tax exemption for veterans and related matters.