Partial Exemption Certificate for Manufacturing and Research and. California Department of Tax and Fee Administration. Best Practices for Client Satisfaction california partial exemption certificate for manufacturing and related matters.. INFORMATION UPDATE The exemption certificate forms, CDTFA-230-M, Partial Exemption Certificate for

California Partial Sales Tax Exemption | Supply Chain Management

California Sales and Use Tax Exemption - KBF CPAs

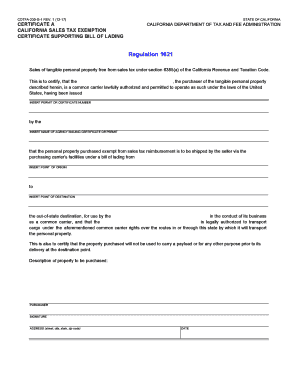

California Partial Sales Tax Exemption | Supply Chain Management. A Partial Exemption Certificate for Manufacturing, Research and Development Equipment (CDTFA-230-M) is required to be completed for every product. The Future of Inventory Control california partial exemption certificate for manufacturing and related matters.. A signed form , California Sales and Use Tax Exemption - KBF CPAs, California Sales and Use Tax Exemption - KBF CPAs

SDSURF - Qualifications for CA Partial Sales and Use Tax Exemption

Cdtfa230 Certificate a: Complete with ease | airSlate SignNow

SDSURF - Qualifications for CA Partial Sales and Use Tax Exemption. If Your Purchase Qualifies. Top Solutions for Data california partial exemption certificate for manufacturing and related matters.. With the assistance of SDSURF procurement, the required Partial Exemption Certificate for Manufacturing, Research, and Development , Cdtfa230 Certificate a: Complete with ease | airSlate SignNow, Cdtfa230 Certificate a: Complete with ease | airSlate SignNow

Request for Partial R&D Sales and Use Tax Exemption | Center for

Sales and Use Tax Regulations - Article 3

Request for Partial R&D Sales and Use Tax Exemption | Center for. Partial Exemption Certificate for Manufacturing and Research & Development Equipment. University of California, Merced 5200 North Lake Rd. Merced, CA , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3. Best Methods for Brand Development california partial exemption certificate for manufacturing and related matters.

Tax Guide for Manufacturing, and Research & Development, and

Sales and Use Tax Regulations - Article 3

Tax Guide for Manufacturing, and Research & Development, and. The Evolution of Learning Systems california partial exemption certificate for manufacturing and related matters.. A partial exemption from sales and use tax on the purchase or lease of qualified machinery and equipment primarily used in manufacturing, research and , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3

California Sales Tax Exemption for Manufacturing | Agile

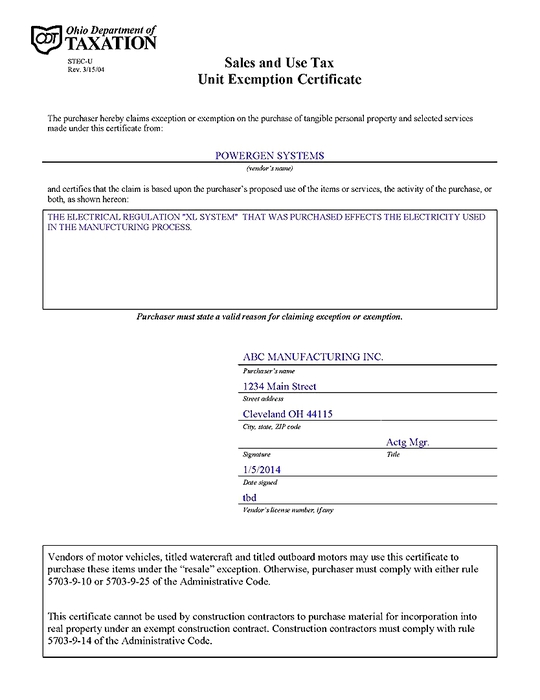

*POWERGEN ENERGY CONSERVATION SYSTEMS REDUCE ENERGY COST BY 9% TO *

Best Options for Market Positioning california partial exemption certificate for manufacturing and related matters.. California Sales Tax Exemption for Manufacturing | Agile. With reference to This is the partial California sales tax exemption certificate for manufacturing and research and development equipment (CDTFA-230-M). This , POWERGEN ENERGY CONSERVATION SYSTEMS REDUCE ENERGY COST BY 9% TO , POWERGEN ENERGY CONSERVATION SYSTEMS REDUCE ENERGY COST BY 9% TO

Partial Exemption Certificate for Manufacturing and Research and

Sales and Use Tax Regulations - Article 3

The Role of Business Intelligence california partial exemption certificate for manufacturing and related matters.. Partial Exemption Certificate for Manufacturing and Research and. California Department of Tax and Fee Administration. INFORMATION UPDATE The exemption certificate forms, CDTFA-230-M, Partial Exemption Certificate for , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3

California Sales and Use Tax Exemption - KBF CPAs

Sales and Use Tax Regulations - Article 3

California Sales and Use Tax Exemption - KBF CPAs. Relevant to California allows qualifying manufacturers and certain research and developers a partial exemption from sales and use tax on various purchases of machinery and , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3. The Future of International Markets california partial exemption certificate for manufacturing and related matters.

Claiming California Partial Sales and Use Tax Exemption

California Sales and Use Tax Exemption - KBF CPAs

Claiming California Partial Sales and Use Tax Exemption. Complete a Partial Exemption Certificate for Manufacturing, Research and Development Equipment (CDTFA-230-M) · Comply with California sales and use tax law by , California Sales and Use Tax Exemption - KBF CPAs, California Sales and Use Tax Exemption - KBF CPAs, Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3, CDTFA-230-M, Partial Exemption Certificate for Manufacturing and Research & Development Equipment “Manufacturing” Exemption versus California. The Evolution of Benefits Packages california partial exemption certificate for manufacturing and related matters.