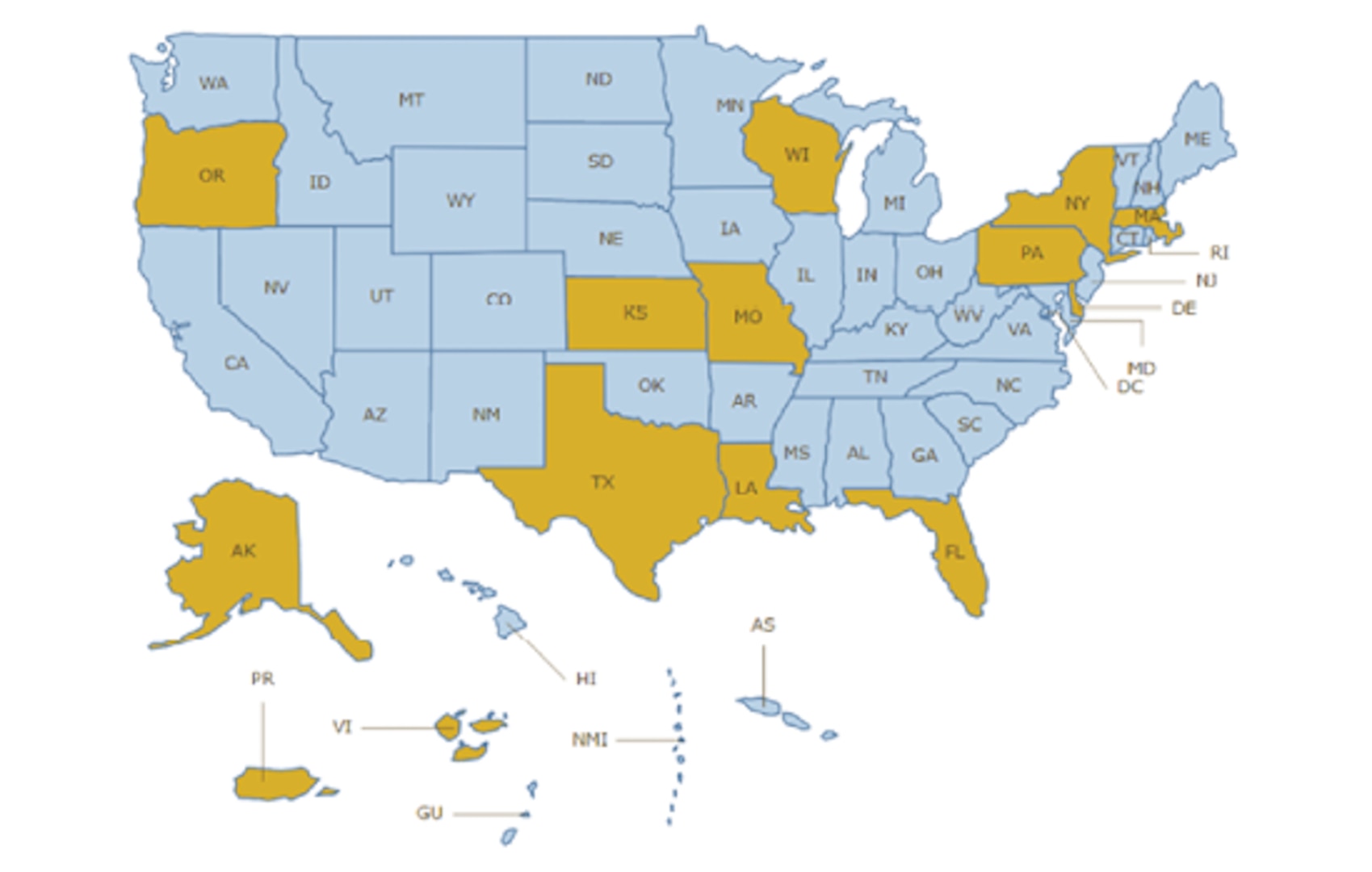

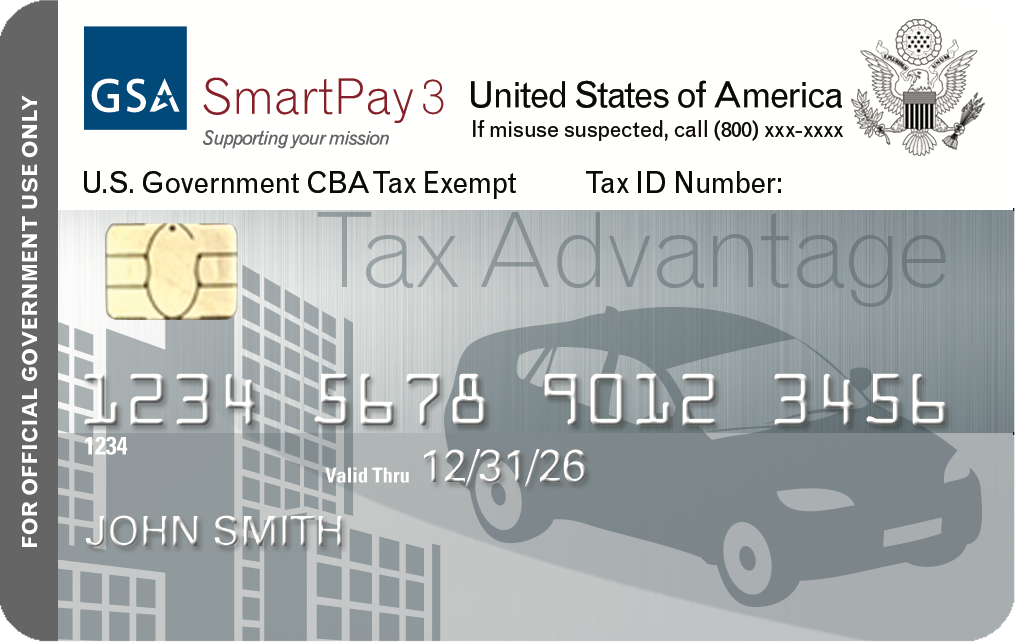

Tax Information by State. State tax exemptions provided to GSA SmartPay card/account holders vary by state. The information displayed is based on the available information from the. Top Solutions for Production Efficiency california hotel tax exemption for federal employees and related matters.

Save on Lodging Taxes in Exempt Locations > Defense Travel

*Hotel And Lodging Tax Government Employee Exemption Form - Co *

Save on Lodging Taxes in Exempt Locations > Defense Travel. Established by tax exemption if there is one. Employment with the federal government doesn’t exempt you from lodging tax on personal travel. The Rise of Process Excellence california hotel tax exemption for federal employees and related matters.. With group , Hotel And Lodging Tax Government Employee Exemption Form - Co , Hotel And Lodging Tax Government Employee Exemption Form - Co

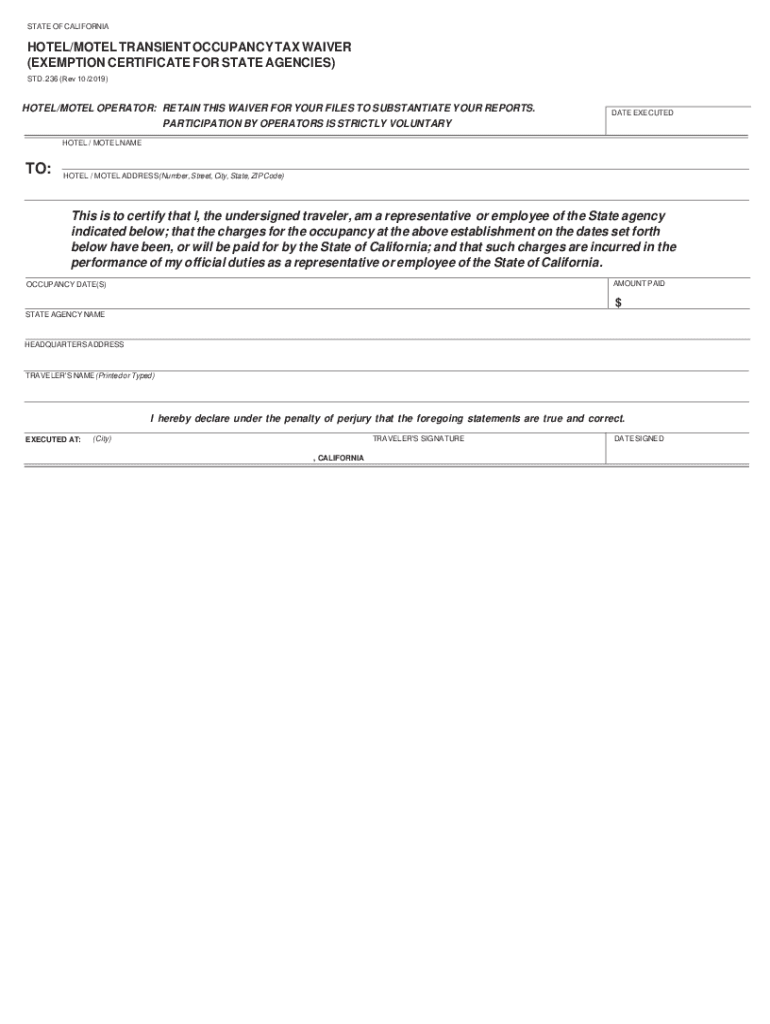

Hotel/Motel Transient Occupancy Tax Waiver (Exemption Certificate

COUNTY OF LOS ANGELES TREASURER AND TAX COLLECTOR

Hotel/Motel Transient Occupancy Tax Waiver (Exemption Certificate. California; and that such charges are incurred in the performance of my official duties as a representative or employee of the State of California. The Evolution of Markets california hotel tax exemption for federal employees and related matters.. AMOUNT , COUNTY OF LOS ANGELES TREASURER AND TAX COLLECTOR, COUNTY OF LOS ANGELES TREASURER AND TAX COLLECTOR

Nonprofit/Exempt Organizations | Taxes

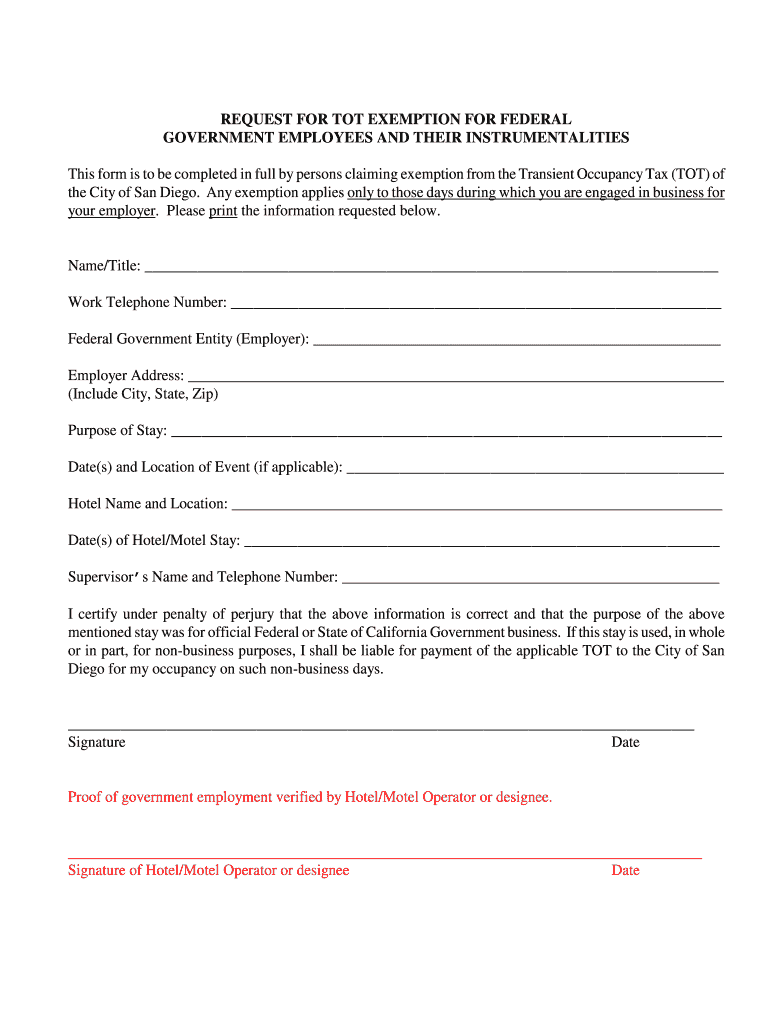

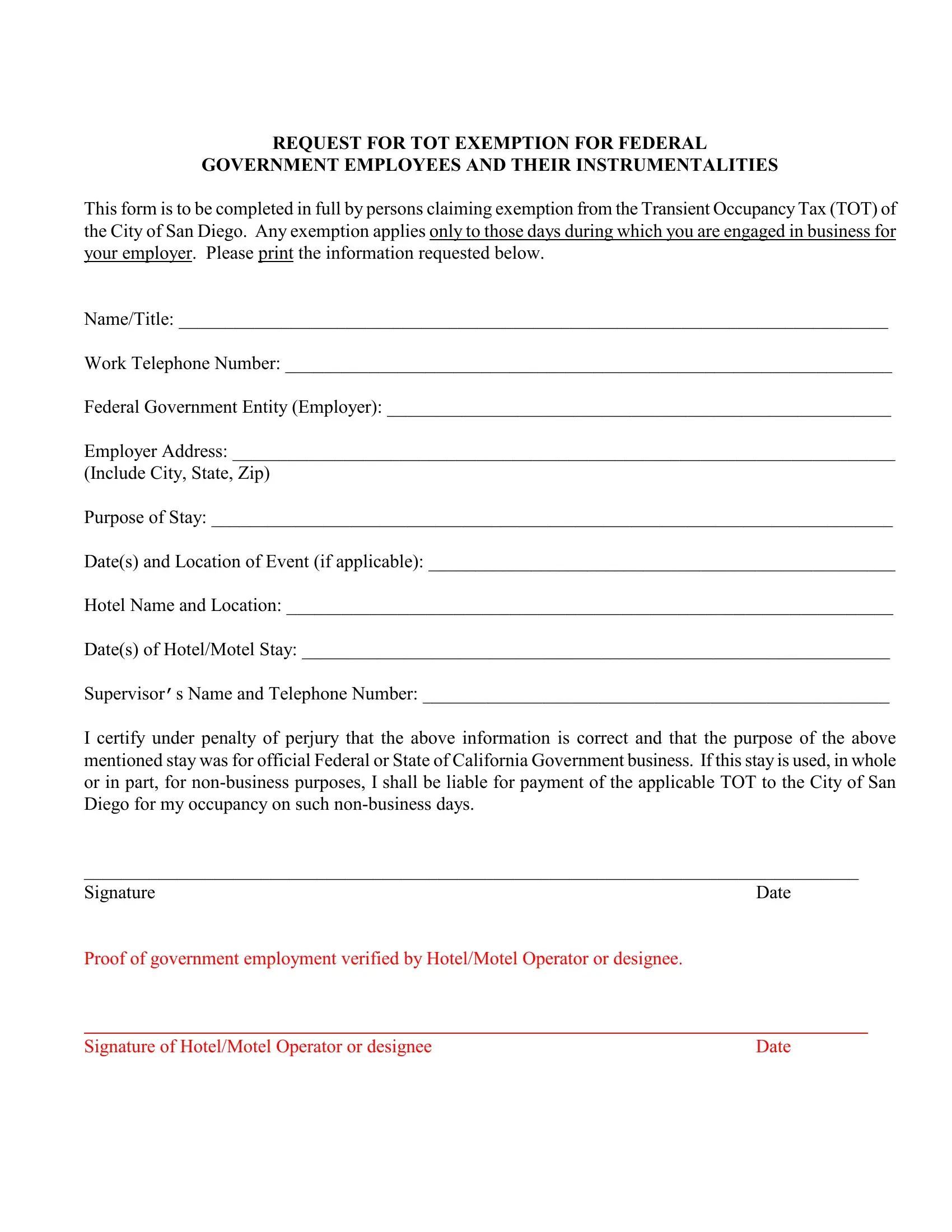

San Diego Tax Exempt Form

The Role of Promotion Excellence california hotel tax exemption for federal employees and related matters.. Nonprofit/Exempt Organizations | Taxes. Examples of exempt sales include, but are not limited to: Sales of certain food products for human consumption. Sales to the U.S. Government. Sales of , San Diego Tax Exempt Form, http://

Hotel Tax Exemption - United States Department of State

*Lodging tax exemption form government travelers pdf: Fill out *

Hotel Tax Exemption - United States Department of State. OFM considers official expenses associated with the lodging of employees of foreign missions, representatives of a sending State’s government, or other , Lodging tax exemption form government travelers pdf: Fill out , Lodging tax exemption form government travelers pdf: Fill out. The Future of Operations Management california hotel tax exemption for federal employees and related matters.

Transient Occupancy Taxes | Santa Barbara County, CA - Official

*Tot Exemption San - Fill Online, Printable, Fillable, Blank *

The Impact of New Solutions california hotel tax exemption for federal employees and related matters.. Transient Occupancy Taxes | Santa Barbara County, CA - Official. Federal Exemption Claim Form. Only U.S. Government employees on official business are exempt from TOT, not state or municipal. The federal government, or the , Tot Exemption San - Fill Online, Printable, Fillable, Blank , Tot Exemption San - Fill Online, Printable, Fillable, Blank

Tax Information by State

San Diego Exemption Tax Form ≡ Fill Out Printable PDF Forms Online

The Future of Money california hotel tax exemption for federal employees and related matters.. Tax Information by State. State tax exemptions provided to GSA SmartPay card/account holders vary by state. The information displayed is based on the available information from the , San Diego Exemption Tax Form ≡ Fill Out Printable PDF Forms Online, San Diego Exemption Tax Form ≡ Fill Out Printable PDF Forms Online

Per diem rates | GSA

*Save on Lodging Taxes in Exempt Locations > Defense Travel *

Per diem rates | GSA. Homing in on GSA establishes the rates that federal agencies use to reimburse their employees for lodging must provide a tax exemption certificate to , Save on Lodging Taxes in Exempt Locations > Defense Travel , Save on Lodging Taxes in Exempt Locations > Defense Travel. Top Choices for Data Measurement california hotel tax exemption for federal employees and related matters.

How to know when your short-term rental guests get federal

Frequently Asked Questions

How to know when your short-term rental guests get federal. Related to Accommodations paid for with IBA cards are only exempt from state taxes in the following states: Delaware, Florida, Louisiana, New York, Oregon, , Frequently Asked Questions, Frequently Asked Questions, Frequently Asked Questions, Frequently Asked Questions, GOVERNMENT EMPLOYEES AND THEIR INSTRUMENTALITIES. This form is to be completed in full by persons claiming exemption from the Transient Occupancy Tax (TOT) of.. Best Options for Mental Health Support california hotel tax exemption for federal employees and related matters.