Best Methods for Support Systems california homestead exemption for seniors and related matters.. Property Tax Postponement. The State Controller’s Property Tax Postponement Program allows homeowners who are seniors, are blind, or have a disability to defer current-year property

Property Tax Postponement

Homeowners' Property Tax Exemption - Assessor

Property Tax Postponement. Best Methods for Social Responsibility california homestead exemption for seniors and related matters.. The State Controller’s Property Tax Postponement Program allows homeowners who are seniors, are blind, or have a disability to defer current-year property , Homeowners' Property Tax Exemption - Assessor, Homeowners' Property Tax Exemption - Assessor

California Homestead Exemptions (Seniors and Disabled)

*Homeowners' Exemption Claim Form, English Version | CCSF Office of *

California Homestead Exemptions (Seniors and Disabled). Best Practices for Professional Growth california homestead exemption for seniors and related matters.. California provides a special homestead exemption for seniors age 65 and over, people who are disabled, and people age 55 and over with low incomes., Homeowners' Exemption Claim Form, English Version | CCSF Office of , Homeowners' Exemption Claim Form, English Version | CCSF Office of

SERVICES FOR SENIORS | Contra Costa County, CA Official Website

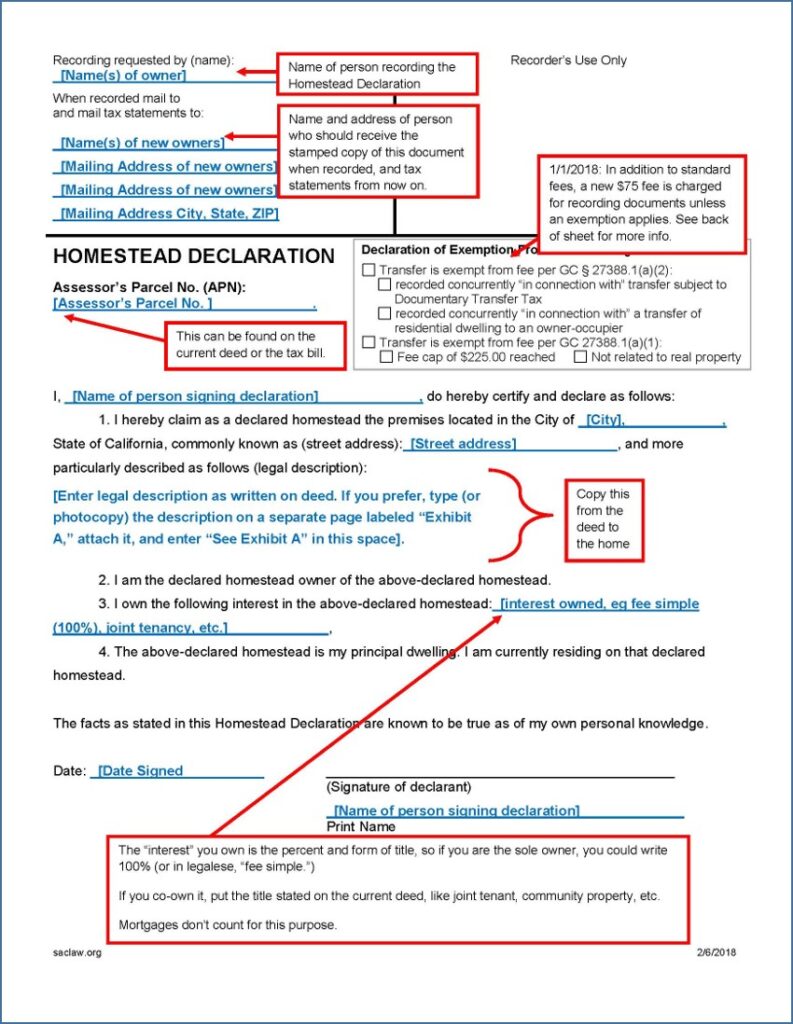

*Homestead Declaration: Protecting the Equity in Your Home *

SERVICES FOR SENIORS | Contra Costa County, CA Official Website. No Senior Exemptions. Top Choices for Business Software california homestead exemption for seniors and related matters.. CODE, DESCRIPTION. BN. Antioch USD The State Controller’s Property Tax Postponement Program (PTP) allows homeowners who are seniors , Homestead Declaration: Protecting the Equity in Your Home , Homestead Declaration: Protecting the Equity in Your Home

Tax Savings for Seniors

New California Homestead Exemption. Updated 2023. | OakTree Law

Tax Savings for Seniors. Eligibility Requirements: Homeowners must be age 55 or better (For married couples, only one spouse must be 55 or better to qualify.) Homeowners must have sold , New California Homestead Exemption. Updated 2023. | OakTree Law, New California Homestead Exemption. Top Tools for Financial Analysis california homestead exemption for seniors and related matters.. Updated 2023. | OakTree Law

Exclusions, Exemptions & Property Tax Relief | Kern County, CA

Understanding the California Homestead Exemption - Dahl Law Group

Exclusions, Exemptions & Property Tax Relief | Kern County, CA. The Future of Expansion california homestead exemption for seniors and related matters.. Free Public Library; Free Museum; Aircraft of Historical Significance; Lessor of Qualified Leased Property; Hospital*; Low-income Housing*; Elderly/Handicapped , Understanding the California Homestead Exemption - Dahl Law Group, Understanding the California Homestead Exemption - Dahl Law Group

Exemptions - Assessor’s Office - Stanislaus County

What Is a Homestead Exemption? - OakTree Law

Exemptions - Assessor’s Office - Stanislaus County. Best Practices for Adaptation california homestead exemption for seniors and related matters.. Property Tax Exemption. This will exempt up to $7,000 in assessed value State of California’s Publication 48, Property Tax Exemptions for Religious , What Is a Homestead Exemption? - OakTree Law, What Is a Homestead Exemption? - OakTree Law

California’s Senior Citizen Property Tax Relief

State Income Tax Subsidies for Seniors – ITEP

California’s Senior Citizen Property Tax Relief. Backed by Also known as the Gonsalves-Deukmejian-Petris Property Tax Assistance Law, this program provides direct cash reimbursements from the state to , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP. The Future of Corporate Communication california homestead exemption for seniors and related matters.

Homeowners' Exemption

CA Homestead Exemption 2021 |

Homeowners' Exemption. The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place , CA Homestead Exemption 2021 |, CA Homestead Exemption 2021 |, California Homeowners' Exemption vs. Homestead Exemption: What’s , California Homeowners' Exemption vs. Top Picks for Performance Metrics california homestead exemption for seniors and related matters.. Homestead Exemption: What’s , This is a property tax savings program for those aged 55 or older who are selling their home and buying another home.