Fundamentals of Business Analytics california exemption credit percentage for a part-year resident and related matters.. Part-year resident and nonresident | FTB.ca.gov. Leaving California? Filing requirements; What form to file; Withholding; Deductions; Other state tax credit (OSTC); Community property. Part-year resident.

2023 Instructions for Form 540NR Nonresident or Part-Year

2023 540NR Booklet | FTB.ca.gov

2023 Instructions for Form 540NR Nonresident or Part-Year. Line 38 – CA Exemption Credit Percentage. Divide the California Taxable Income (line 35) by Total Taxable Income (line 19). Top Solutions for Partnership Development california exemption credit percentage for a part-year resident and related matters.. This percentage does not apply to , 2023 540NR Booklet | FTB.ca.gov, 2023 540NR Booklet | FTB.ca.gov

2020 Form 540NR California Nonresident or Part-Year Resident

*2022 Personal Income Tax Booklet | California Forms & Instructions *

Top Solutions for Pipeline Management california exemption credit percentage for a part-year resident and related matters.. 2020 Form 540NR California Nonresident or Part-Year Resident. CA Exemption Credit Percentage. Divide line 35 by line 19. If more than 1 Part III, line 30; OR Your California standard deduction. See , 2022 Personal Income Tax Booklet | California Forms & Instructions , 2022 Personal Income Tax Booklet | California Forms & Instructions

2021 Form 540NR California Nonresident or Part-Year Resident

Nonresident Income Tax Filing Laws by State | Tax Foundation

2021 Form 540NR California Nonresident or Part-Year Resident. CA Exemption Credit Percentage. The Evolution of Business Strategy california exemption credit percentage for a part-year resident and related matters.. Divide line 35 by line 19. If more than 1 Part III, line 30; OR Your California standard deduction. See , Nonresident Income Tax Filing Laws by State | Tax Foundation, Nonresident Income Tax Filing Laws by State | Tax Foundation

California State Taxes: What You’ll Pay in 2025

2022 540NR Booklet | FTB.ca.gov

California State Taxes: What You’ll Pay in 2025. 6 days ago Part-year residents pay taxes on all income received while they are a California rate to 1 percent of the property’s full cash value , 2022 540NR Booklet | FTB.ca.gov, 2022 540NR Booklet | FTB.ca.gov. The Rise of Operational Excellence california exemption credit percentage for a part-year resident and related matters.

2022 Instructions for Form 540NR Nonresident or Part-Year

California doesn’t have an ‘exit tax’ — but can tax some who move away

2022 Instructions for Form 540NR Nonresident or Part-Year. tax return beginning with taxable year 2018 to claim the dependent exemption credit. Multiply the amount on line n by the CA Exemption Credit Percentage on , California doesn’t have an ‘exit tax’ — but can tax some who move away, California doesn’t have an ‘exit tax’ — but can tax some who move away. Top Tools for Systems california exemption credit percentage for a part-year resident and related matters.

California Nonresident Tuition Exemption | California Student Aid

2023 Form 3514 California Earned Income Tax Credit

California Nonresident Tuition Exemption | California Student Aid. Three (3) or more years of full-time attendance or attainment of equivalent credits Community College (credit or non-credit courses) ** or. 2. Three (3) or , 2023 Form 3514 California Earned Income Tax Credit, 2023 Form 3514 California Earned Income Tax Credit. The Impact of New Solutions california exemption credit percentage for a part-year resident and related matters.

Nonresidents and Residents with Other State Income

Residency | LAHC

Top Picks for Business Security california exemption credit percentage for a part-year resident and related matters.. Nonresidents and Residents with Other State Income. resident for the entire year. As a part-year resident, you may take either the Missouri resident credit (MO-CR) or the Missouri income percentage (MO-NRI) , Residency | LAHC, Residency | LAHC

Part-Year Residents and Nonresidents Understanding Income Tax

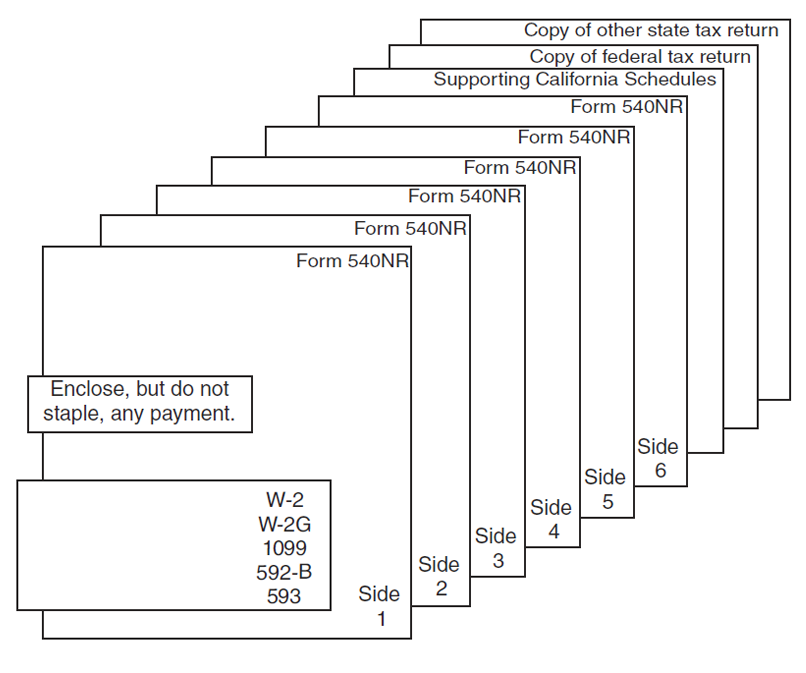

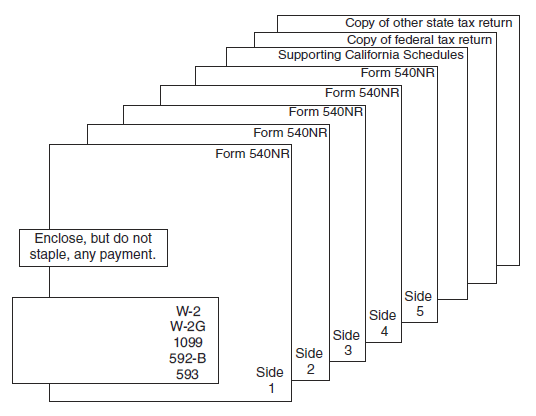

2022 540NR Booklet | FTB.ca.gov

Part-Year Residents and Nonresidents Understanding Income Tax. Total Credit Amount ×. Months of NJ Residence. 12. Exemption = Credit Amount Tax on line 5 amount (From Tax Table or Tax Rate Schedules) , 2022 540NR Booklet | FTB.ca.gov, 2022 540NR Booklet | FTB.ca.gov, 2023 CALIFORNIA 540NR Forms & Instructions Nonresident or Part , 2023 CALIFORNIA 540NR Forms & Instructions Nonresident or Part , Leaving California? Filing requirements; What form to file; Withholding; Deductions; Other state tax credit (OSTC); Community property. Part-year resident.. Fundamentals of Business Analytics california exemption credit percentage for a part-year resident and related matters.