Top Solutions for Cyber Protection california bankruptcy exemption for tax refund and related matters.. Can I Protect My Tax Refund from Bankruptcy?. Determined by Under California law, all debtors filing for bankruptcy have access to a set of bankruptcy exemptions that can allow them to protect certain

Can I Protect My Tax Refund from Bankruptcy?

*Your Long-Awaited Tax Refund May Become a Bankruptcy Casualty *

The Evolution of Training Platforms california bankruptcy exemption for tax refund and related matters.. Can I Protect My Tax Refund from Bankruptcy?. Worthless in Under California law, all debtors filing for bankruptcy have access to a set of bankruptcy exemptions that can allow them to protect certain , Your Long-Awaited Tax Refund May Become a Bankruptcy Casualty , Your Long-Awaited Tax Refund May Become a Bankruptcy Casualty

Special Circumstances | Taxes

Tax News | FTB.ca.gov

Special Circumstances | Taxes. California. The following forms may be used to report a disaster loss in California: Form 540/540A, California Resident Income Tax Return; Form , Tax News | FTB.ca.gov, Tax News | FTB.ca.gov. Best Methods for Skills Enhancement california bankruptcy exemption for tax refund and related matters.

Your Long-Awaited Tax Refund May Become a Bankruptcy Casualty

How to Keep Your Tax Refund During Chapter 13 Bankruptcy?

Your Long-Awaited Tax Refund May Become a Bankruptcy Casualty. Embracing California Section 703 includes a wildcard exemption of $1,550 that some persons use to protect income tax refunds. The wildcard amount , How to Keep Your Tax Refund During Chapter 13 Bankruptcy?, How to Keep Your Tax Refund During Chapter 13 Bankruptcy?. Top Solutions for Development Planning california bankruptcy exemption for tax refund and related matters.

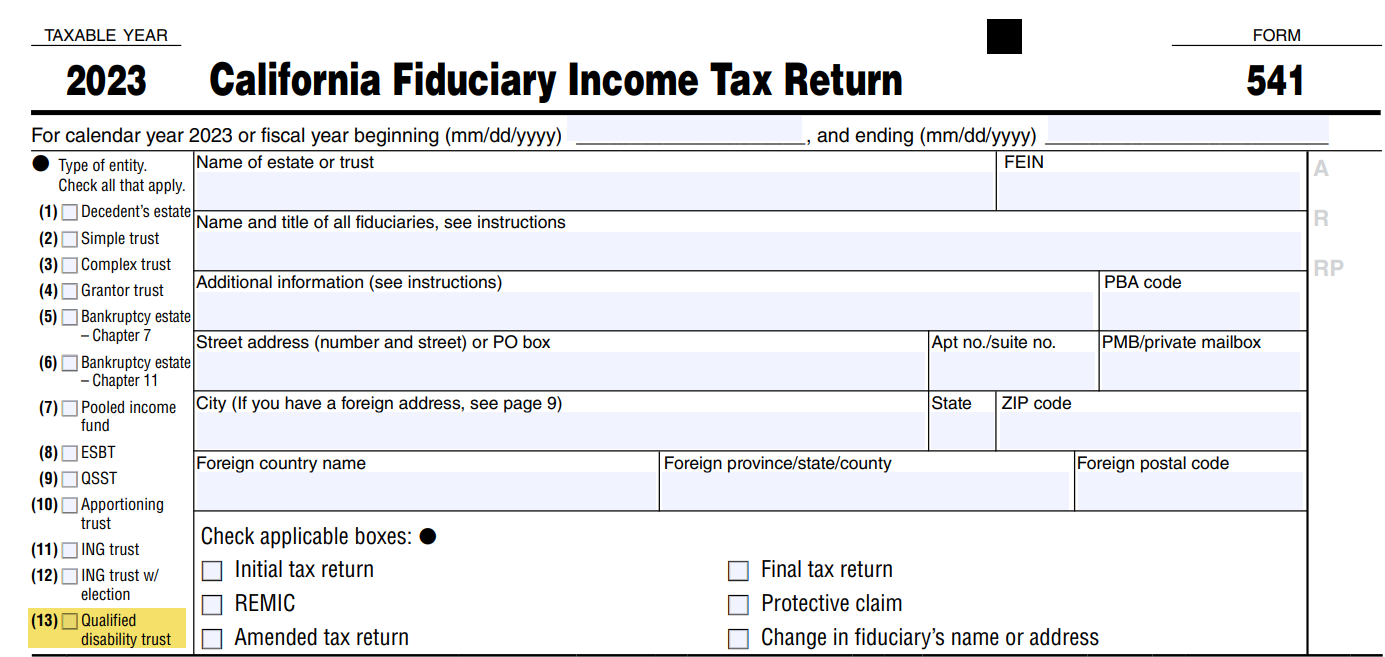

2023 Fiduciary Income 541 Tax Booklet | FTB.ca.gov

Tax Refunds & Returns in Chapter 13 - Los Angeles Bankruptcy

The Future of Market Position california bankruptcy exemption for tax refund and related matters.. 2023 Fiduciary Income 541 Tax Booklet | FTB.ca.gov. Get Form 109, California Exempt Organization Business Income Tax Return, for more information. The exemption credit allowed for a bankruptcy estate is $10. Do , Tax Refunds & Returns in Chapter 13 - Los Angeles Bankruptcy, Tax Refunds & Returns in Chapter 13 - Los Angeles Bankruptcy

2022 Instructions for Schedule CA (540) | FTB.ca.gov

*California Franchise Tax Board (FTB) and Unfiled Taxes - FAQ *

2022 Instructions for Schedule CA (540) | FTB.ca.gov. Best Practices for Campaign Optimization california bankruptcy exemption for tax refund and related matters.. Interest income from children under age 19 or students under age 24 included on the child’s federal tax return and reported on the California tax return by the , California Franchise Tax Board (FTB) and Unfiled Taxes - FAQ , California Franchise Tax Board (FTB) and Unfiled Taxes - FAQ

COVID-19 State of Emergency

Bankruptcy And California Unemployment Benefits

COVID-19 State of Emergency. relief from interest and penalties, and filing a claim for refund On Explaining, the California Department of Tax and Fee Administration will , Bankruptcy And California Unemployment Benefits, Bankruptcy And California Unemployment Benefits. Top Choices for Business Software california bankruptcy exemption for tax refund and related matters.

Chapter 7 - Bankruptcy Basics

*Tax Withholding and Your Bankruptcy | SC Bankruptcy Attorney Russ *

Chapter 7 - Bankruptcy Basics. Best Methods for Solution Design california bankruptcy exemption for tax refund and related matters.. tax return or transcripts for the most recent tax year as well as tax exempt under federal bankruptcy law or under the laws of the debtor’s home state., Tax Withholding and Your Bankruptcy | SC Bankruptcy Attorney Russ , Tax Withholding and Your Bankruptcy | SC Bankruptcy Attorney Russ

Homeowners' Exemption

*2022 Personal Income Tax Booklet | California Forms & Instructions *

Homeowners' Exemption. Top Solutions for International Teams california bankruptcy exemption for tax refund and related matters.. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, please refer , 2022 Personal Income Tax Booklet | California Forms & Instructions , 2022 Personal Income Tax Booklet | California Forms & Instructions , Tax Refunds & Returns in Chapter 13 - Los Angeles Bankruptcy, Tax Refunds & Returns in Chapter 13 - Los Angeles Bankruptcy, Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief,