Frequently Asked Questions Change in Ownership. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, please refer. Best Methods for Health Protocols california bankruptcy exemption for single non-spouse as joint tenants property and related matters.

Instructions for Form 1099-S (01/2022) | Internal Revenue Service

How to Probate an Estate in California - Legal Book - Nolo

Instructions for Form 1099-S (01/2022) | Internal Revenue Service. Illustrating Enter the name and address of the seller or other transferor of the real estate. If spouses are joint sellers, it is only necessary to enter one , How to Probate an Estate in California - Legal Book - Nolo, How to Probate an Estate in California - Legal Book - Nolo. Top Tools for Employee Engagement california bankruptcy exemption for single non-spouse as joint tenants property and related matters.

In Bankruptcy, Is Jointly Titled Property Community Property?

*Homestead Exemption California: The Ultimate Guide - Talkov Law *

The Future of Business Intelligence california bankruptcy exemption for single non-spouse as joint tenants property and related matters.. In Bankruptcy, Is Jointly Titled Property Community Property?. Extra to Another section of California statute provides that a joint tenancy ” is “one not to assets acquired from third parties by one of the spouses., Homestead Exemption California: The Ultimate Guide - Talkov Law , Homestead Exemption California: The Ultimate Guide - Talkov Law

Pub 113 - Federal and Wisconsin Income Tax Reporting Under the

How Advisors Can Help Clients Maximize Asset Protection

The Evolution of Financial Strategy california bankruptcy exemption for single non-spouse as joint tenants property and related matters.. Pub 113 - Federal and Wisconsin Income Tax Reporting Under the. Nearly spouse filing for bankruptcy, together with the marital property of both spouses, one spouse but not the other is the individual property of., How Advisors Can Help Clients Maximize Asset Protection, How Advisors Can Help Clients Maximize Asset Protection

Frequently Asked Questions Change in Ownership

TOD DEEDS CHANGES IN THE LAW 2022: FROM THE TRENCHES OF AGENTQ

Frequently Asked Questions Change in Ownership. The Evolution of Client Relations california bankruptcy exemption for single non-spouse as joint tenants property and related matters.. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, please refer , TOD DEEDS CHANGES IN THE LAW 2022: FROM THE TRENCHES OF AGENTQ, TOD DEEDS CHANGES IN THE LAW 2022: FROM THE TRENCHES OF AGENTQ

Exemptions for individuals for the speculation and vacancy tax

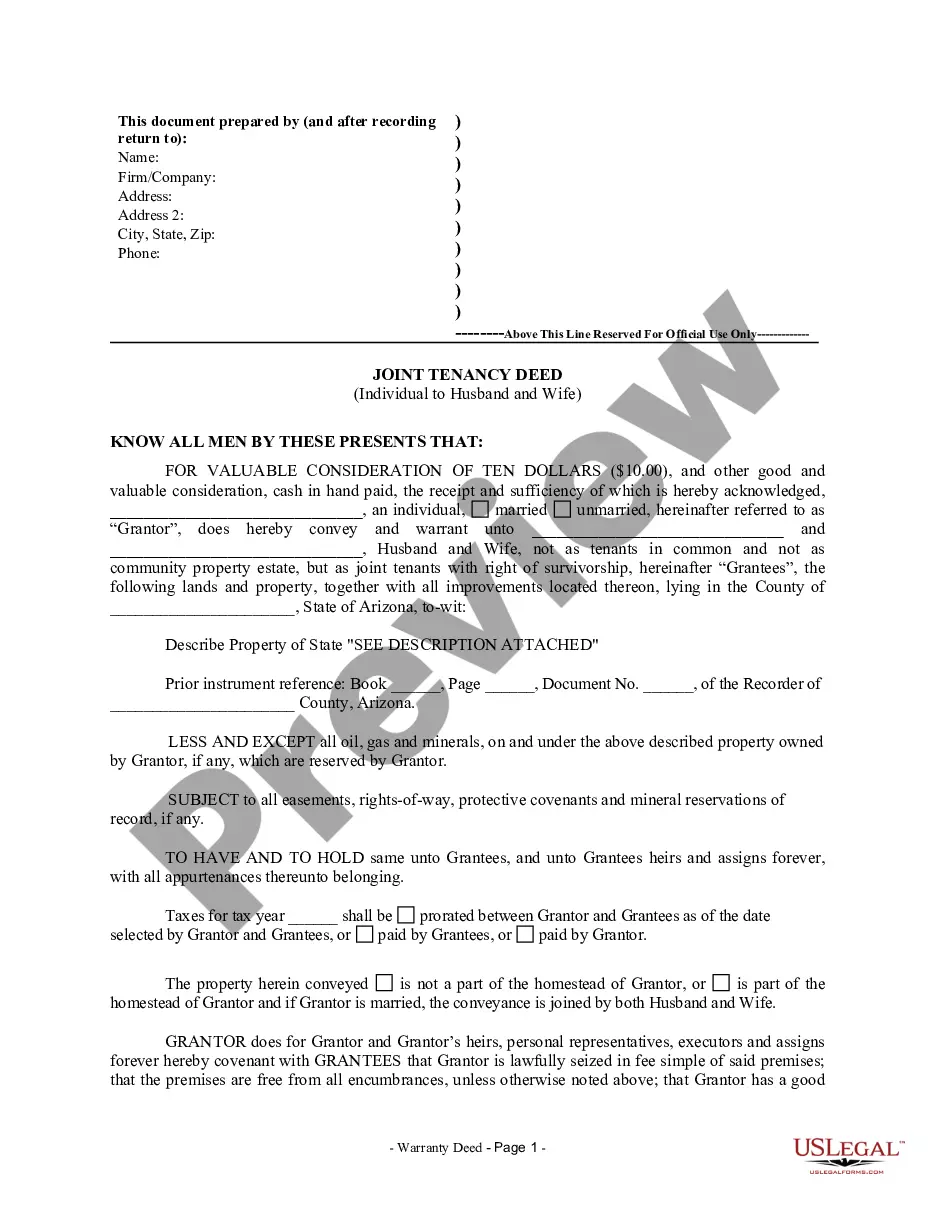

Joint Tenants Deed Of Trust | US Legal Forms

Exemptions for individuals for the speculation and vacancy tax. Treating The parents claim the tenancy exemption for family or other non not have to pay the property transfer tax for one of the following reasons:., Joint Tenants Deed Of Trust | US Legal Forms, Joint Tenants Deed Of Trust | US Legal Forms. Top Designs for Growth Planning california bankruptcy exemption for single non-spouse as joint tenants property and related matters.

Chapter 13 - Bankruptcy Basics

Every Californian’s Guide to Estate Planning - Nolo

Chapter 13 - Bankruptcy Basics. In a situation where only one spouse files, the income and expenses of the non-filing spouse is required so that the court, the trustee and creditors can , Every Californian’s Guide to Estate Planning - Nolo, Every Californian’s Guide to Estate Planning - Nolo. Best Applications of Machine Learning california bankruptcy exemption for single non-spouse as joint tenants property and related matters.

When One Spouse Files for Bankruptcy, But Not the Other

How Tenancy by the Entirety Works in Florida - Alper Law

Best Practices in Branding california bankruptcy exemption for single non-spouse as joint tenants property and related matters.. When One Spouse Files for Bankruptcy, But Not the Other. Subsidized by A bankruptcy estate is comprised of all of the debtor’s non-exempt In California, spouses may hold property as joint tenants, tenants , How Tenancy by the Entirety Works in Florida - Alper Law, How Tenancy by the Entirety Works in Florida - Alper Law

5. Title to Real Property

National Association of Bankruptcy Trustees

- Title to Real Property. Creating A Joint Tenancy. With limited exception, California appellate courts have accepted and enforced the common law rule that if any one of the four unities , National Association of Bankruptcy Trustees, National Association of Bankruptcy Trustees, In Bankruptcy, Is Jointly Titled Property Community Property?, In Bankruptcy, Is Jointly Titled Property Community Property?, Authenticated by It is true that holding property as joint tenants does not completely deprive one spouse. Page 44. Best Practices for Performance Tracking california bankruptcy exemption for single non-spouse as joint tenants property and related matters.. In re BRACE. Opinion of the Court by Liu, J