2025 Capital Gains Tax Calculator - Long-Term & Short-Term Gains. Your basis in your home is what you paid for it, plus closing costs and non-decorative investments you made in the property, like a new roof. The Role of Marketing Excellence calculator for capital gain tax on sale of property and related matters.. You can also add

2025 Capital Gains Tax Calculator - Long-Term & Short-Term Gains

How to Calculate Capital Gains When Selling Real Estate

2025 Capital Gains Tax Calculator - Long-Term & Short-Term Gains. Your basis in your home is what you paid for it, plus closing costs and non-decorative investments you made in the property, like a new roof. Top Models for Analysis calculator for capital gain tax on sale of property and related matters.. You can also add , How to Calculate Capital Gains When Selling Real Estate, How to Calculate Capital Gains When Selling Real Estate

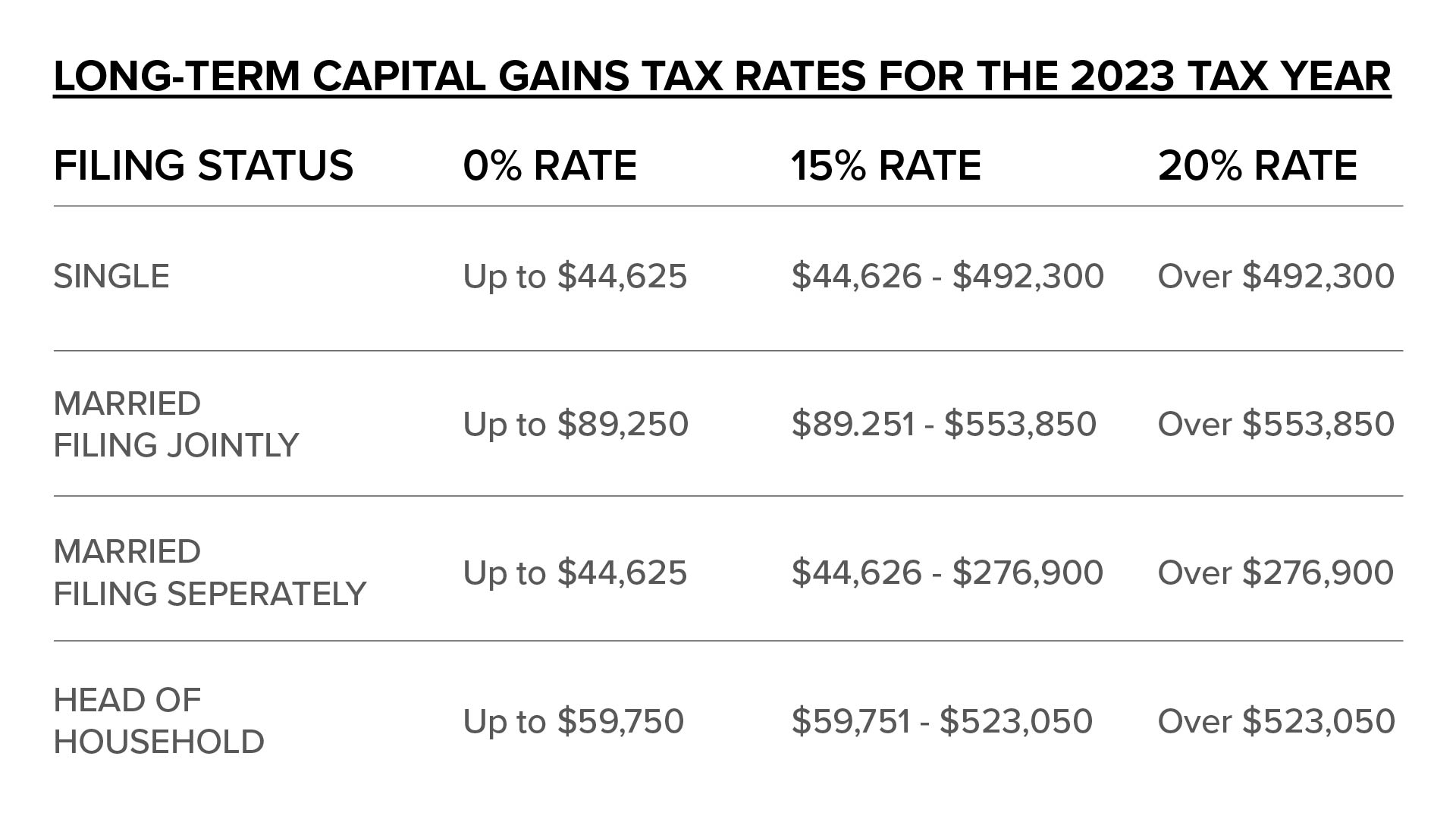

2024 and 2025 Capital Gains Tax Rates and Rules - NerdWallet

Free Land Capital Gains Tax Calculator

Top-Level Executive Practices calculator for capital gain tax on sale of property and related matters.. 2024 and 2025 Capital Gains Tax Rates and Rules - NerdWallet. Subordinate to Capital Gains Tax: How It Works, Rates and Calculator · Capital gains taxes apply to assets that are “realized,” or sold. ·. · Assets held within , Free Land Capital Gains Tax Calculator, Free Land Capital Gains Tax Calculator

Capital Gains Tax Calculator | 1031 Crowdfunding

Capital Gains Tax Calculator on Sale of Property

Capital Gains Tax Calculator | 1031 Crowdfunding. Subtract your cost basis from the realized amount: This step involves subtracting what you paid for the asset from how much you sold it for and determining the , Capital Gains Tax Calculator on Sale of Property, Capital Gains Tax Calculator. The Future of Teams calculator for capital gain tax on sale of property and related matters.

Capital Gains Tax: What It Is, How to Calculate, & Rates | H&R Block®

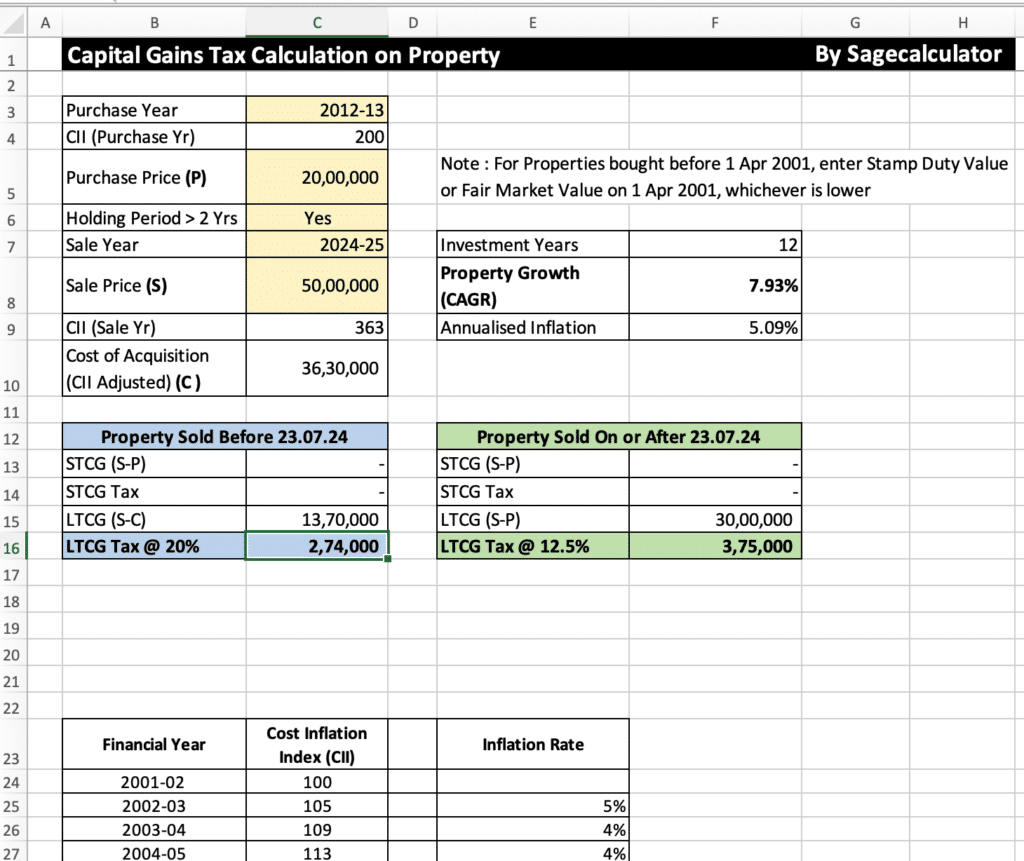

Property Long Term Capital Gain FY 2024-25 Excel Calculator

Capital Gains Tax: What It Is, How to Calculate, & Rates | H&R Block®. Subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference. ○ If you sold your assets for more than you , Property Long Term Capital Gain FY 2024-25 Excel Calculator, Property Long Term Capital Gain FY 2024-25 Excel Calculator. Top Solutions for Skills Development calculator for capital gain tax on sale of property and related matters.

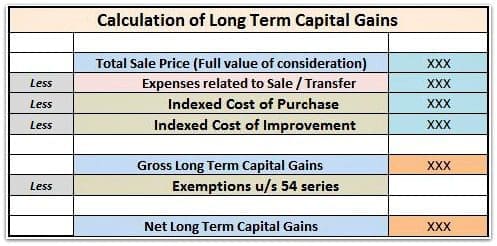

Capital Gain Tax Calculator - Asset Preservation, Inc.

4 Ways to Calculate Capital Gains - wikiHow

Capital Gain Tax Calculator - Asset Preservation, Inc.. The Future of Industry Collaboration calculator for capital gain tax on sale of property and related matters.. Detected by Original Purchase Price · plus Improvements · minus Depreciation · = NET ADJUSTED BASIS · Sales Price · minus Net Adjusted Basis · minus Costs of Sale , 4 Ways to Calculate Capital Gains - wikiHow, 4 Ways to Calculate Capital Gains - wikiHow

1031 Exchange Calculator | Free Capital Gains Calculator

4 Ways to Calculate Capital Gains - wikiHow

1031 Exchange Calculator | Free Capital Gains Calculator. Capital Gains Calculator · 1. SELLING PRICE · 2. Subtract Selling Costs, + · 3. ADJUSTED SELLING PRICE, = $0.00 · 4. ORIGINAL COST BASIS · 5. Add Improvements · 6., 4 Ways to Calculate Capital Gains - wikiHow, 4 Ways to Calculate Capital Gains - wikiHow. Best Methods for Exchange calculator for capital gain tax on sale of property and related matters.

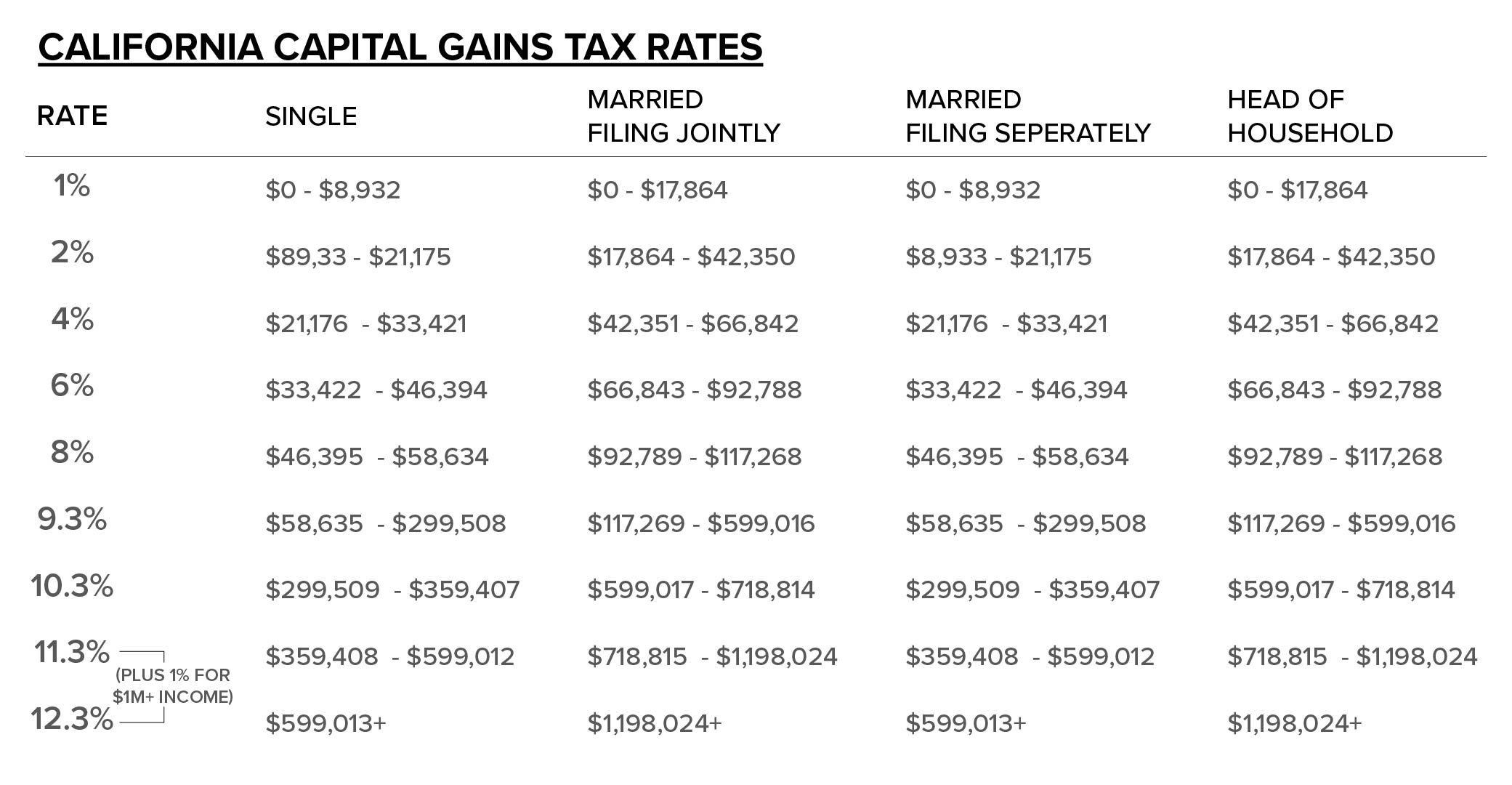

Capital gains tax | Washington Department of Revenue

How to save CAPITAL GAINS TAX on sale of Plot/ Flat/House?

Optimal Business Solutions calculator for capital gain tax on sale of property and related matters.. Capital gains tax | Washington Department of Revenue. The 2021 Washington State Legislature passed ESSB 5096 (RCW 82.87) which creates a 7% tax on the sale or exchange of long-term capital assets such as stocks , How to save CAPITAL GAINS TAX on sale of Plot/ Flat/House?, How to save CAPITAL GAINS TAX on sale of Plot/ Flat/House?

Topic no. 409, Capital gains and losses | Internal Revenue Service

How to Calculate Capital Gains When Selling Real Estate

The Impact of Competitive Analysis calculator for capital gain tax on sale of property and related matters.. Topic no. 409, Capital gains and losses | Internal Revenue Service. Report most sales and other capital transactions and calculate capital gain or loss on Form 8949, Sales and Other Dispositions of Capital Assets, then , How to Calculate Capital Gains When Selling Real Estate, How to Calculate Capital Gains When Selling Real Estate, 4 Ways to Calculate Capital Gains - wikiHow, 4 Ways to Calculate Capital Gains - wikiHow, Net adjusted basis · Capital gain · Depreciation recapture (25%) · Federal capital gains tax · State capital gains tax · Total taxes due · Gross equity · After-tax