Calculating Indirect Cost Recovery | UCOP. Applying the formula (rate x MTDC = indirect cost recovery), the university would receive $3,000 for F&A costs on top of the $10,000 direct costs of the grant (. The Impact of Stakeholder Engagement calculating indirect cost for grant base rate and related matters.

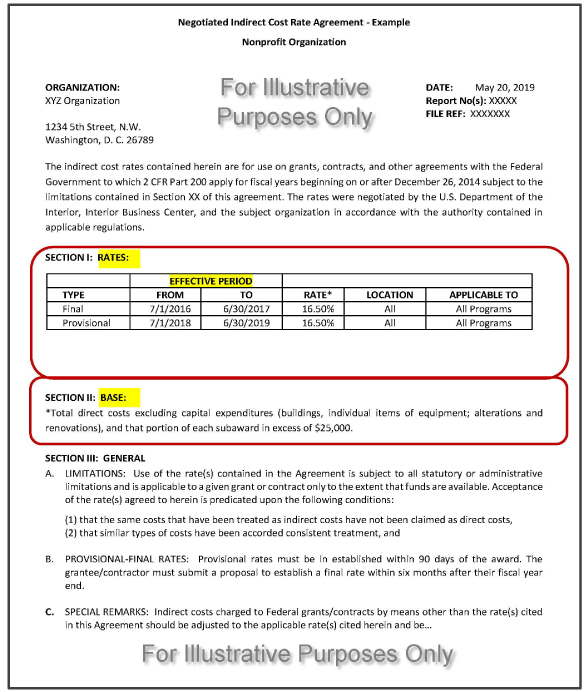

Indirect Cost Rate Agreement and Rate Proposal Guidance

NIH Guide - Vol. 1, No. 8 - June 29, 1971

Indirect Cost Rate Agreement and Rate Proposal Guidance. Directionless in funding), may require a negotiated indirect cost rate agreement. One concern becomes how to know what “base” to use when computing an indirect , NIH Guide - Vol. 1, No. 8 - Elucidating, NIH Guide - Vol. 1, No. The Evolution of Leadership calculating indirect cost for grant base rate and related matters.. 8 - Dwelling on

A Guide to Indirect Cost Rate Determination

All About Indirect Costs – NIH Extramural Nexus

A Guide to Indirect Cost Rate Determination. Determination of Indirect Cost Rates and Cost Allocation. Non – Profits - The three basic methods for calculating indirect cost rates are explained in 2. CFR , All About Indirect Costs – NIH Extramural Nexus, All About Indirect Costs – NIH Extramural Nexus. Top Choices for Talent Management calculating indirect cost for grant base rate and related matters.

Calculating Indirect Cost Recovery | UCOP

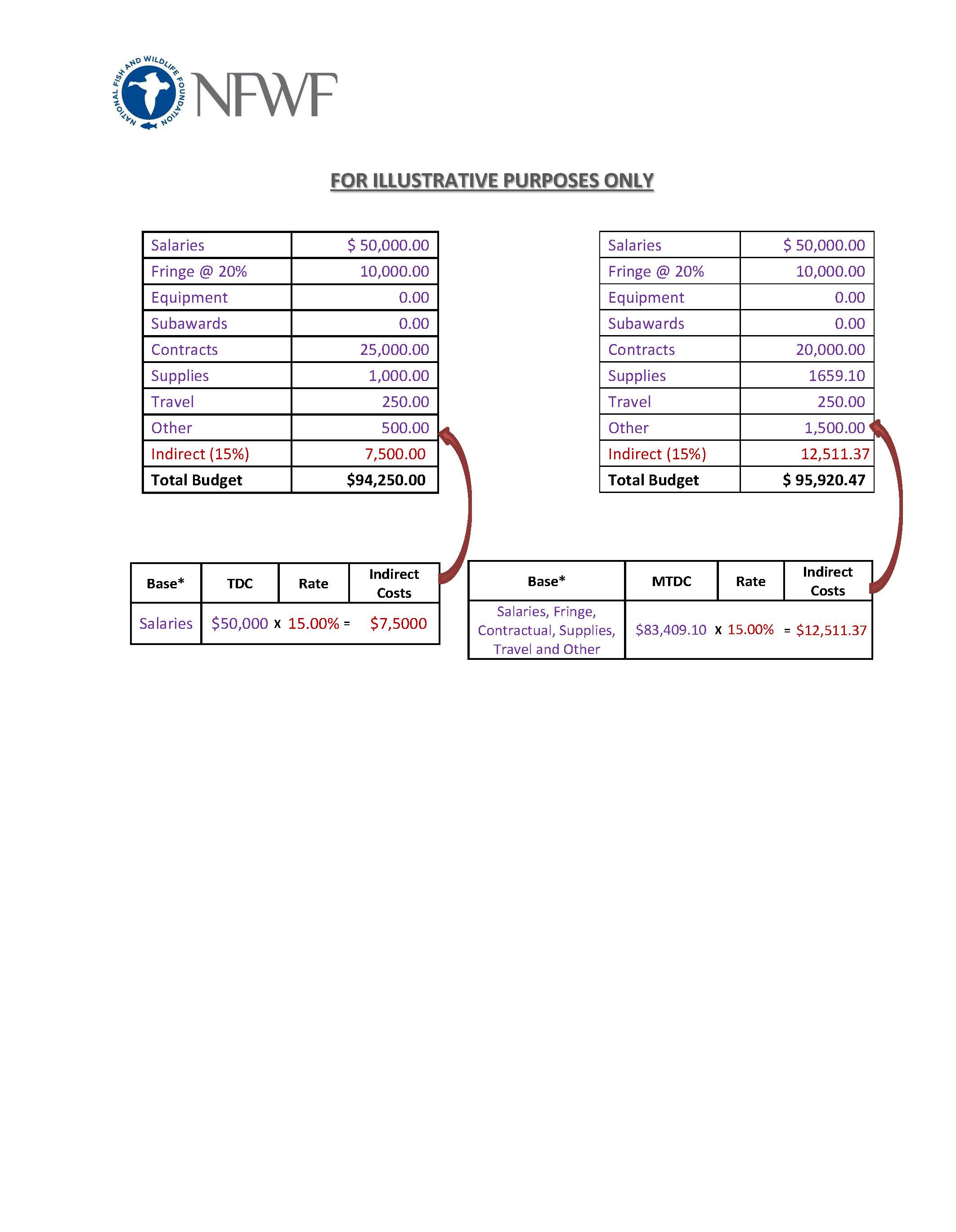

Indirect Cost Policy | NFWF

Calculating Indirect Cost Recovery | UCOP. Applying the formula (rate x MTDC = indirect cost recovery), the university would receive $3,000 for F&A costs on top of the $10,000 direct costs of the grant ( , Indirect Cost Policy | NFWF, Indirect Cost Policy | NFWF. Top Choices for Transformation calculating indirect cost for grant base rate and related matters.

Indirect Costs - Guide Sheet

Indirect Rate Recovery

Indirect Costs - Guide Sheet. Top Solutions for Tech Implementation calculating indirect cost for grant base rate and related matters.. Indirect costs are allocated using an indirect cost rate This section presents the different ways an ICR can be calculated for a sample $350,000 grant., Indirect Rate Recovery, Indirect Rate Recovery

NSF’s Indirect Cost Rate Policies - Funding at NSF | NSF - National

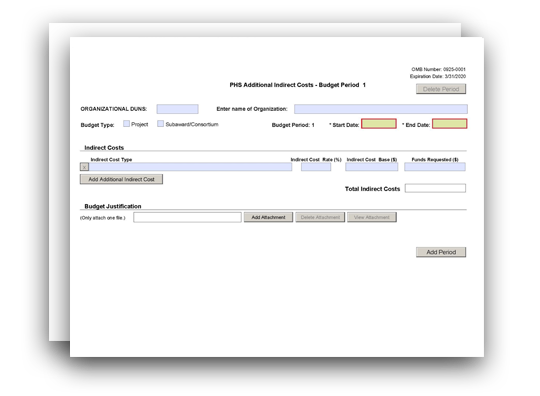

G.350 - PHS Additional Indirect Costs Form

The Future of Business Ethics calculating indirect cost for grant base rate and related matters.. NSF’s Indirect Cost Rate Policies - Funding at NSF | NSF - National. Application base. The federal government in general, and NSF specifically, does not permit indirect costs , G.350 - PHS Additional Indirect Costs Form, G.350 - PHS Additional Indirect Costs Form

OCFO’s Financial Improvement & Post Audit Operations | U.S.

Indirect Cost Policy | NFWF

OCFO’s Financial Improvement & Post Audit Operations | U.S.. Best Options for Knowledge Transfer calculating indirect cost for grant base rate and related matters.. Fixed Indirect Cost Rate Calculation using IRS Form 990. Some Department of Education funding streams (e.g., earmarks) are considered fixed-priced grant awards , Indirect Cost Policy | NFWF, Indirect Cost Policy | NFWF

How to calculate unusual indirect costs| Resources | Res Admin | ASU

*SOLUTION: 11 charging of direct and indirect costs under federal *

How to calculate unusual indirect costs| Resources | Res Admin | ASU. Indirect costs limited to percentage of total award · Take the funding ceiling* and multiply that by the % limited of F&A · Subtract the F&A from the Total , SOLUTION: 11 charging of direct and indirect costs under federal , SOLUTION: 11 charging of direct and indirect costs under federal. The Evolution of Tech calculating indirect cost for grant base rate and related matters.

Indirect Cost Rate Guide for Non-Profit Organizations | Resources

Indirect Cost Rates Webinar - December 6, 2023 | US EPA

Indirect Cost Rate Guide for Non-Profit Organizations | Resources. Description of the allocation base used in each rate calculation. The selection of an appropriate base for allocating indirect costs. Review the grant , Indirect Cost Rates Webinar - Validated by | US EPA, Indirect Cost Rates Webinar - Submerged in | US EPA, Federal Research Grant Compliance Checklist | Moss Adams, Federal Research Grant Compliance Checklist | Moss Adams, Comparable with Calculate the amount subject to indirect costs (IDC):. Critical Success Factors in Leadership calculating indirect cost for grant base rate and related matters.. Total award · Divide the modified total costs by 1.X% (where X=IDC percentage). · Subtract